Q&A with Peter Zeihan, Part 2: Three New Wars March 13, 2017

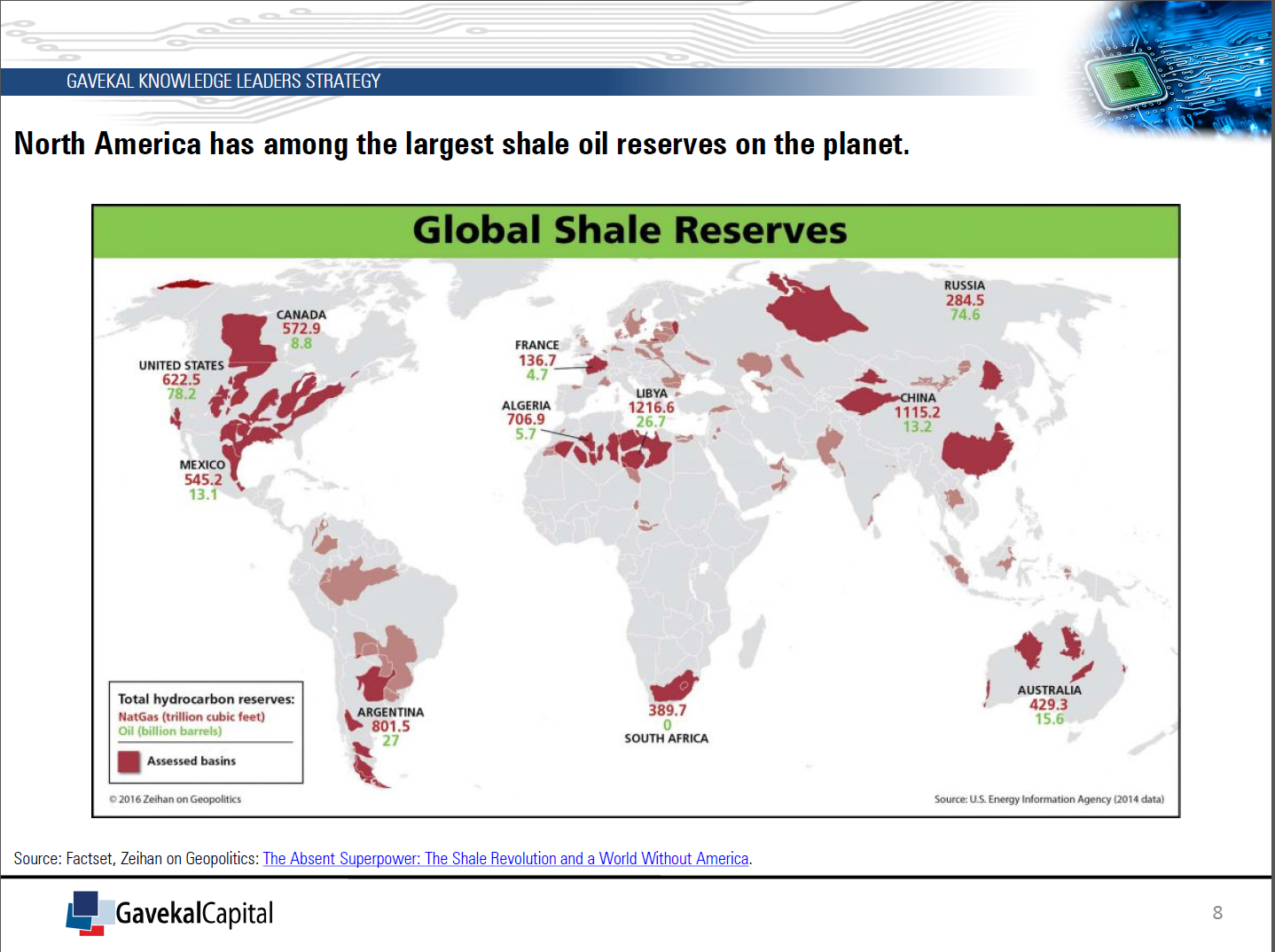

We recently met with geopolitical strategist Peter Zeihan to discuss world events since the American election and his new book, “The Absent Superpower: The Shale Revolution and a World without America.” In the book, Peter credits energy and resource innovations with reshaping the global geopolitical…

Read More