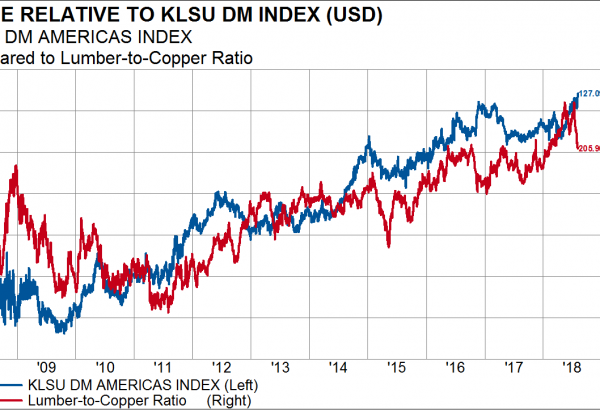

Most commodities have suffered lately with the backdrop of tariffs and China’s devaluation. But some have fared worse than others, and there is information content to the relative move in commodities. While copper catches many of the headlines (i.e. Dr. Copper, the metal with a…

Read MoreEconomy

Quarterly Strategy Update: What We Know, What We Think & What We Are Unsure Of July 26, 2018

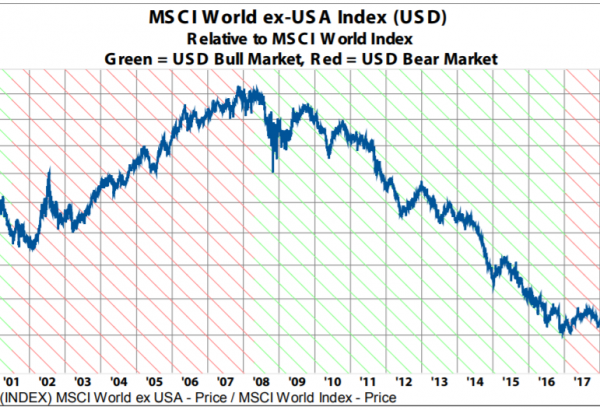

Recently, fears of a slowdown in global growth brought on by a trade war have led to turbulence in cyclical assets. The US Dollar has risen while commodities and emerging markets have struggled. The Chinese Yuan has depreciated significantly, recalling fears of the 2014-2016 industrial…

Read MoreYield Curve Inversion: Not What it Appears July 17, 2018

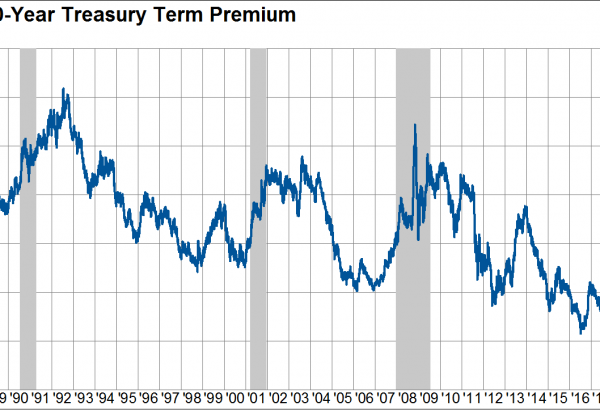

There has been considerable discussion lately about the slowly inverting yield curve and what it may signal for growth prospects going forward. Commonly used as a proxy for the yield curve is the spread between 10-Year US Treasury yields and 2-Year US Treasury yields. As…

Read MoreThe US shale boom has led to a surge in the production of crude oil, and much of this production has been exported in recent years. In the chart below, I plot the gross exports of crude oil from the US. Beginning with almost nothing…

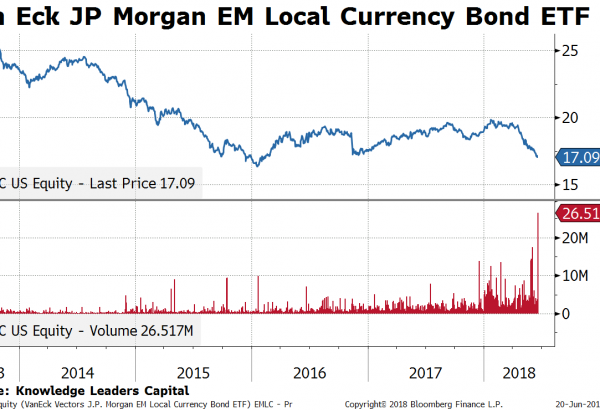

Read MoreEM Capitulation June 21, 2018

Yesterday, someone threw in the towel on EM bonds. The Van Eck JP Morgan Emerging Market Local Currency Debt ETF (EMLC) is the largest and most liquid vehicle to invest in emerging market local currency bonds. In one trade yesterday, someone pushed through a block…

Read MoreWhich is More Impactful to the US: Crude Oil or China Trade? Can Someone Tell Currency Traders? June 20, 2018

Talk of a trade war with China has recently dominated the discussion in financial markets, overshadowing the other major story playing out in the US economy—normalization of the energy markets. I thought I would answer the question of whether trade with China or oil was…

Read MoreMid-Quarter Update: The Monetary Policy Pitchfork June 15, 2018

The big three central banks (Federal Reserve, European Central Bank and the Bank of Japan) met this week to review their monetary stance. In this mid-quarter update, we share our analysis, The Monetary Policy Pitchfork. Summary: After a decade of emergency monetary policy, the major…

Read MoreA Reflationary Inflection in Oil Inventories June 13, 2018

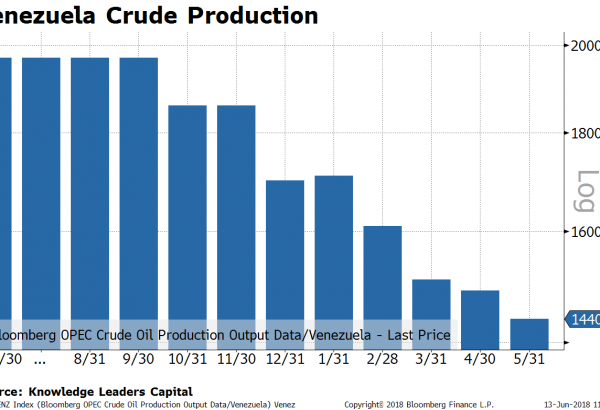

Venezuela has experienced a collapse in oil production this year as the country sinks into chaos. Daily production is down from 1.7M barrels/day at the end of last year to just 1.44M barrels/day at the end of May. Year-over-year production declines are even larger, down…

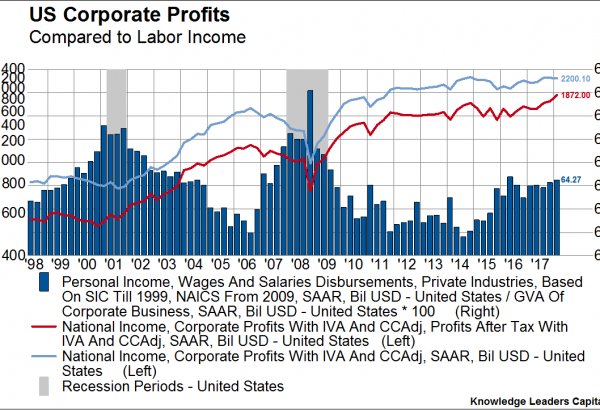

Read MoreDivergent Path of US Corporate Profits May 31, 2018

Yesterday we got the latest glimpse into US corporate profitability. Depending on the series observed, corporate profits are either flat-lining or rising. Before-tax corporate profits, the blue series in the chart below, are actually net down by $32 billion from the peak in 2014. Yet,…

Read MoreAs the Trump administration’s on-again, off-again trade war with China continues to create uncertainty for investors, we sat down with geopolitical strategist Peter Zeihan to learn more about the tariff program and what it could mean for the US economy. Similarly, we discussed the changing outlook…

Read MoreYesterday John Williams, one of the newest members of the Federal Open Market Committee, wrote an article titled “The Future Fortunes of R-star: Are They Really Rising?” where he summarized his views on real neutral interest rates. He began with a short definition: “R-star is…

Read MoreTen-year US treasury rates broke out this week on the back of news that looks unequivocally like an inflationary boom. Earlier in the week the Atlanta wage tracker ticked back up to 3.3% year over year. Wages moving higher, check. Oil prices broke above $71/barrel….

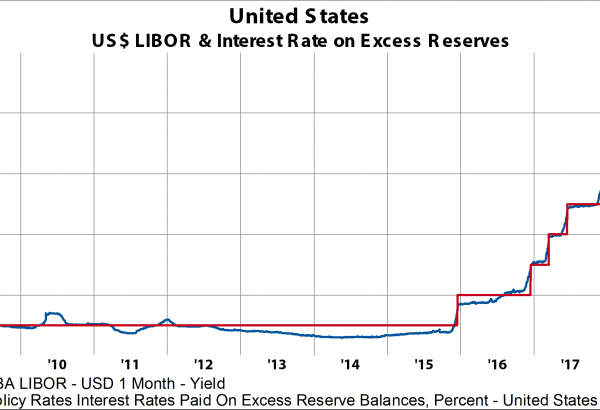

Read MoreUSD Hedging Getting More Expensive: LIBOR-OIS Spread Heading Higher May 09, 2018

There are two basic drivers of the London Interback Offered Rate (LIBOR): 1) policy rates and 2) a variable premium. Starting with the policy rates component, in the chart below I compare the interest rate on excess reserves (IOR) and USD LIBOR. Because the IOR…

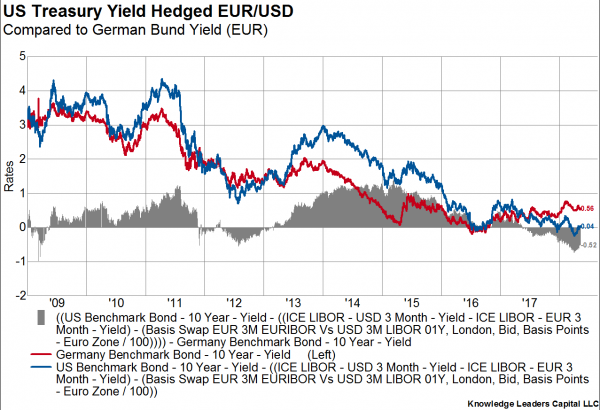

Read MoreWith the European Central Bank dragging its feet to begin the monetary tightening cycle, the difference between US and German rates has opened up to record levels. In the chart below, I show the yield on 10 Year US Treasury Bonds and 10 Year German…

Read MoreQuarterly Strategy Update: Volatility Shocks & Dollar Bears April 26, 2018

Price excesses have built up over a long bull market. Stocks are expensive, and the volatility shock wave is traveling the globe. This quarter, we discuss the risks correlated with the current volatility, potential new sources of instability, and the sectors that could be the…

Read More