As of this writing, WTI crude oil is back above $65/barrel, closing in on the recent $66.33 high on January 26. While oil and US equities have been in a “wedge” formation where, hemmed in by the January 26 high and the February 90 low,…

Read MoreEconomy

Navigating a USD Bear Market with Equity Factors February 27, 2018

The US Dollar appears to have entered a new bear market. In this mid-quarter update, we analyze equity factors and their performance tendencies in recent USD bull and bear markets. Download the slides for Navigating a USD Bear Market with Equity Factors. Questions? Email us at investmenteam@klcapital.com.

Read MoreQuarterly Strategy Update: Breaking Out & Breaking Down January 26, 2018

Oil prices have pushed through resistance and are breaking out while the US dollar has pushed through support and is breaking down. All of the major industrial commodity prices are moving in lock step, while the global economy appears to be accelerating led by the…

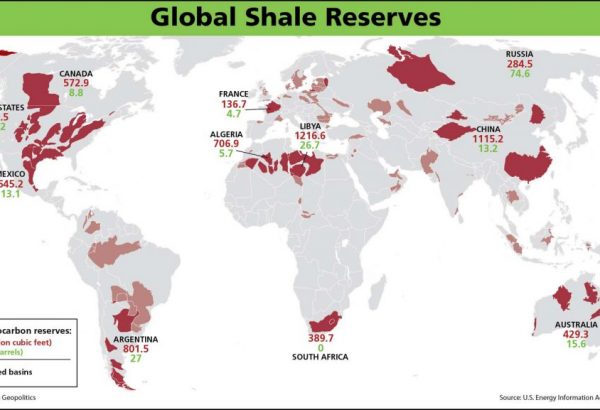

Read MoreWe recently caught up with Peter Zeihan, author of The Accidental Superpower, to ask his thoughts on the top geopolitical shifts to watch in 2018. He shared his predictions on everything from anti-trust concerns for Silicon Valley and the dire consequences for the United States…

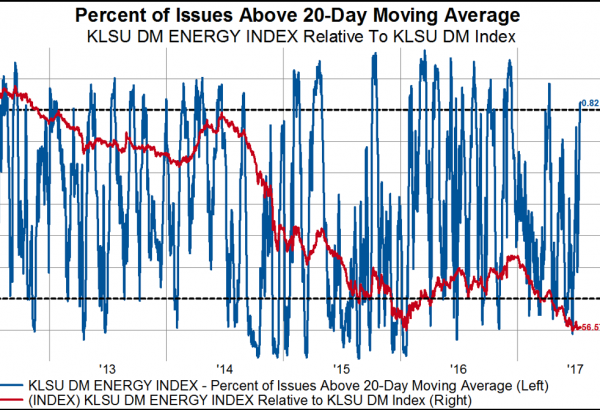

Read MoreSpecial Report on the Energy Industry December 14, 2017

We expect momentum in the energy sector and resource-related currencies to continue into 2018. In this mid-quarter update to investors, we analyze what this means for the market. In summary: Oil prices are testing resistance, and if they can break out, there is significant upside. Oil…

Read MoreCash is an Asset Class Again! November 30, 2017

In a US Dollar bull market with interest rates at zero, cash is rightfully dismissed as a non-asset class. But, when the US Dollar is in a bear cycle, things change, irrespective of what US interest rates are. There are a handful of indicators we…

Read MoreGeopolitics Q&A with Peter Zeihan: Mexico’s New Drug War, North Korea, Russian Expansion November 02, 2017

We recently met with Geopolitical Strategist Peter Zeihan to discuss three geopolitical shifts for US financial advisors to watch in the coming months. In this Q&A, we discuss: How the Mexican drug war fueled the U.S. opioid crisis; The chances of a pre-emptive strike on…

Read MoreQuarterly Strategy Update: Dynamic Undercurrents October 19, 2017

Since the start of this year, the US Treasury market is signaling a scenario of rising growth expectations and falling inflation expectations, as reflected by the various components that comprise interest rates. In this quarter’s strategy update, Portfolio Manager Steven Vannelli, CFA, explores the following:…

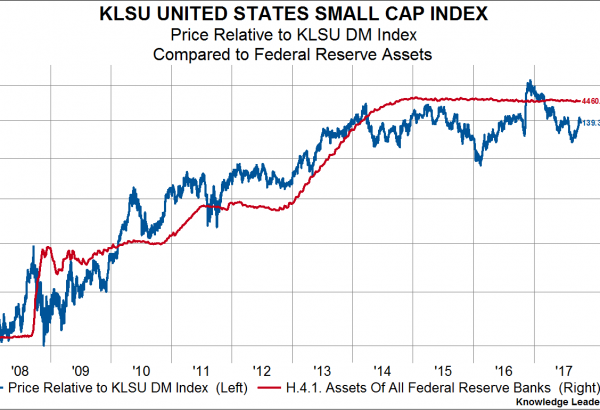

Read MoreThreats for Small Caps October 11, 2017

With some exceptions, smaller-cap stocks in the US tend to pay higher taxes than their larger-cap peers. As such, speculation that corporate tax rates may be cut has stoked the performance of US small caps recently. In addition to the concern that tax reform and/or…

Read MoreThe Impossible Math of the Federal Reserve September 21, 2017

Yesterday the Federal Reserve officially signaled the beginning of its balance sheet run-off. At this point, that’s old news. But, today the Fed released the Z.1 Flow of Funds, which adds to the intrigue of the balance sheet run-off. Why? Instead of getting wrapped up…

Read MoreBack to the Future: A US Dollar Bear Market? September 08, 2017

This slide package is our Knowledge Leaders Strategy mid-quarter update and can be downloaded at the link below. The discussion is broken into three sections: SECTION 1: History does not support the view that the USD is propped up by a monetary tightening cycle. The…

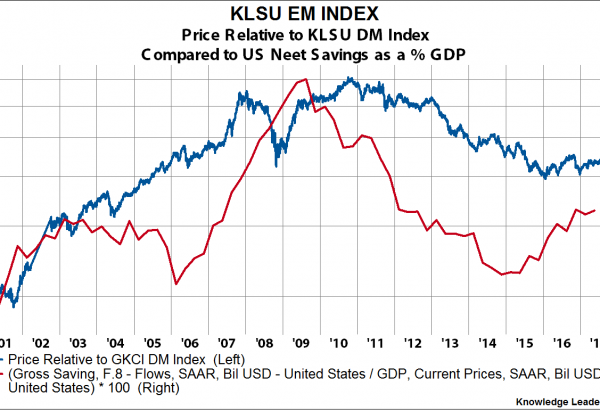

Read MoreWhy Is North America’s Equity Market Underperforming? August 23, 2017

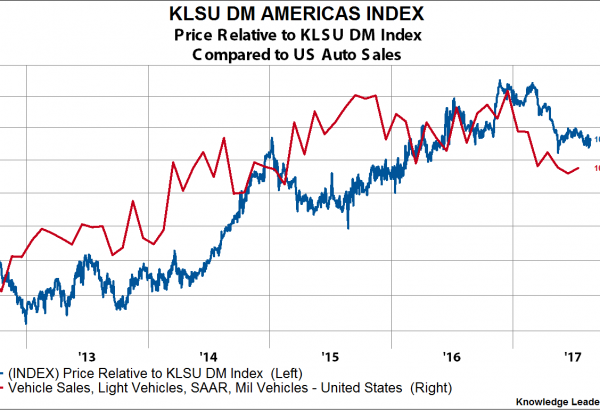

On a relative basis, compared to the developed world, North American stocks peaked on November 23, 2016, and have since underperformed by about 4% (in USD). In the charts below, we compare the relative performance of our KLSU North America Index to various economic variables….

Read MoreWith energy setting records as the worst performing sector year-to-date, we were curious about Geopolitical Strategist Peter Zeihan’s thoughts on fossil fuels in the context of the United States’ continued retreat from the global theater. We recently caught up with Peter to ask his opinion….

Read MoreQuarterly Strategy Update: Structural Rotation July 20, 2017

This quarter, we look at two important structural changes that appear to be underway: a normalization in US and European monetary policy and a normalization in crude oil inventories. We expect these two trends to have important ramifications for equity sector leadership trends. In addition, we expect…

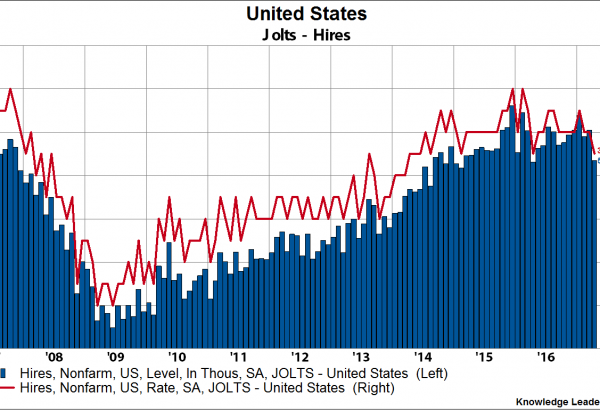

Read MoreToday’s release of the Job Openings & Labor Turnover (JOLTs) revealed a few interesting observations about the US labor market. First, the pace of hires is fading. Keep in mind JOLTs data is released a month after employment data, so we are looking at April…

Read More