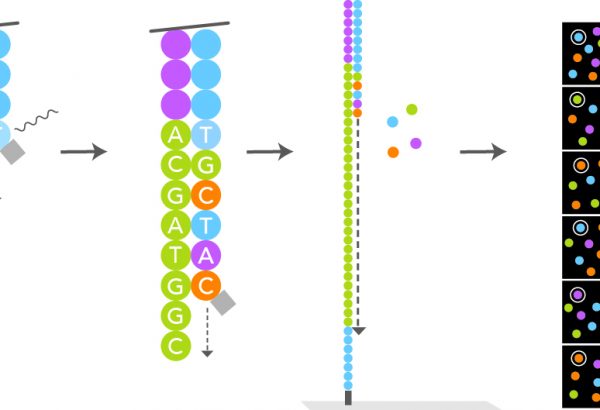

Spotlight Illumina: Unlocking DNA to Protect Humanity from Disease (Including Coronavirus) February 20, 2020

When companies commit to investing in innovation, the results compound over time, leading them to possess deep reservoirs of knowledge. We call these companies Knowledge Leaders, and such is the case for San Diego, California-based Illumina, the world leader in DNA sequencing and the No….

Read More