Keeping a Close Eye On Momentum in the North American Equity Market October 26, 2017

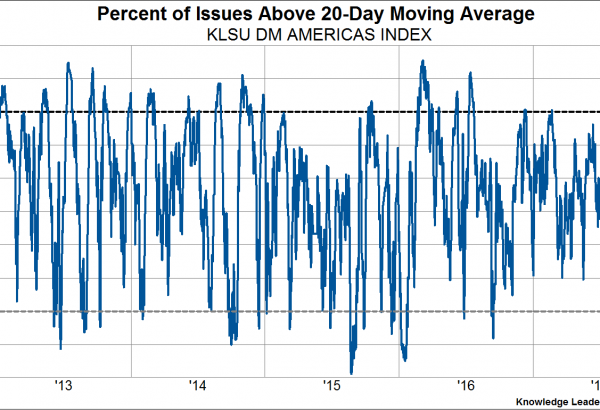

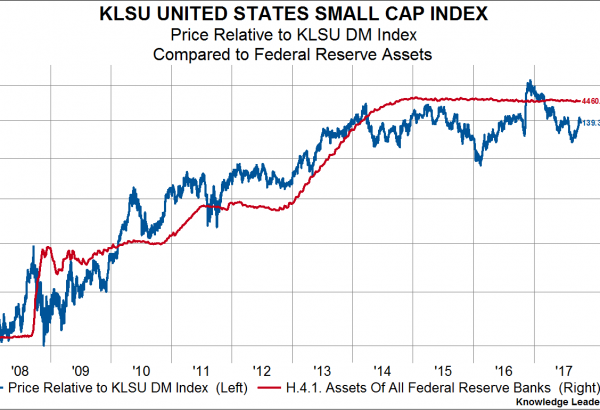

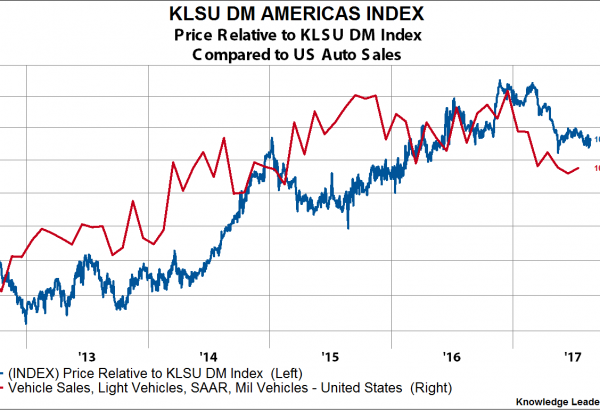

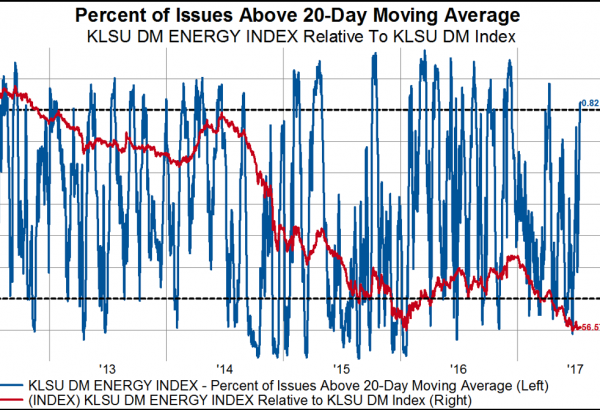

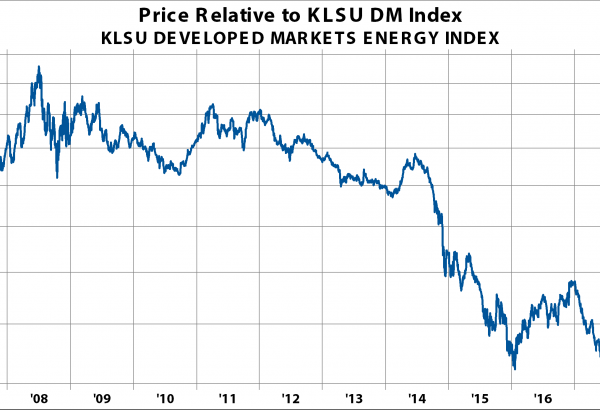

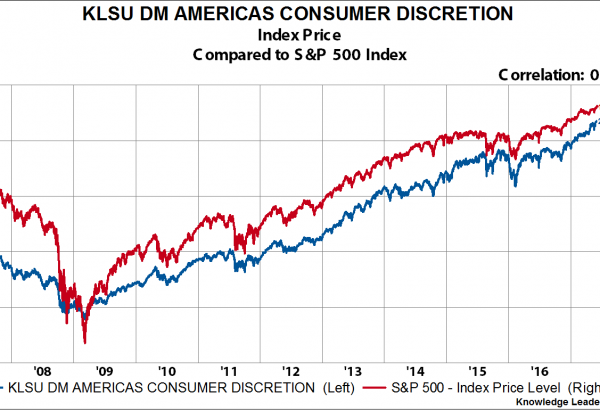

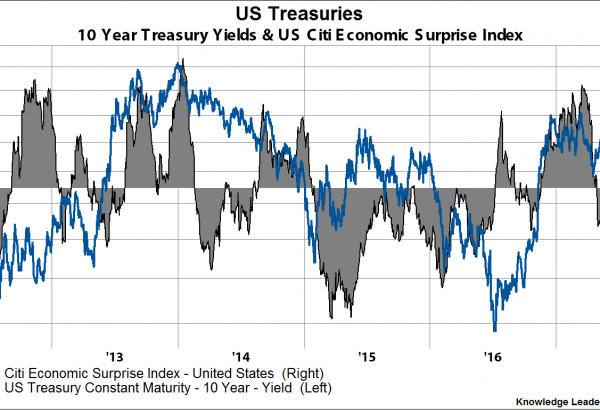

Over the last 20 days, the US equity market is showing early signs of exhaustion, and momentum is beginning to weaken. In the following charts, we’ll highlight the various technical measures we calculate each day to illustrate the early turn in momentum. Our KLSU DM…

Read More