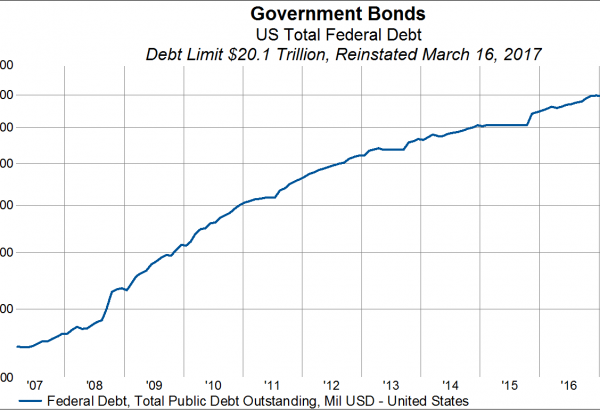

Coming Challenges to US Treasury Investing May 01, 2017

In the table below we show the aggregate US Treasury maturity schedule. Due to stops and starts of the US Treasury issuing longer dated bonds over the last few decades, there is a huge gap in maturities available for investors. The reader will notice that there…

Read More