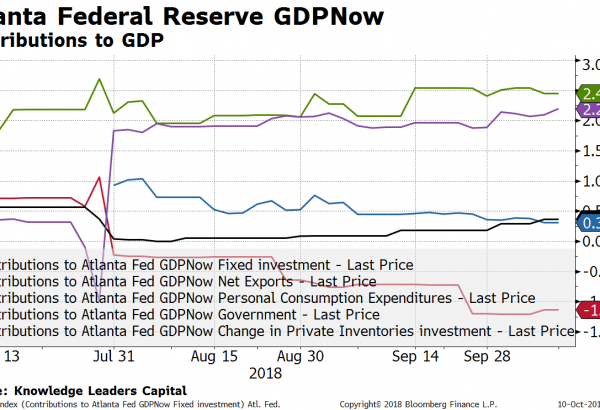

Trade War is Boosting US Economic Activity … in the Short-Term October 10, 2018

Overnight, new data released in China suggests businesses are having a tough time lately. Cheung Kong University produces an alternate PMI Business Conditions Index in association with the China Federation of Logistics and Purchasing. The latest data point plunged more than 10 points from its…

Read More