The Middle of the Yield Curve is Acting Like the Fed Just Completed a Tightening Cycle

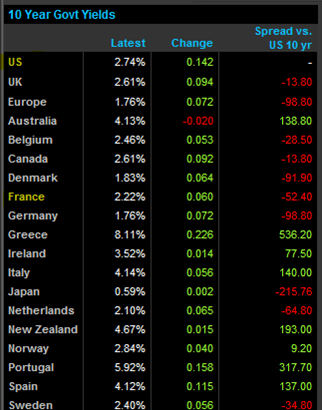

While yields at the long end of the US Treasury market have been heading lower all year (the 30-year has fallen from 3.93% to 3.32% and the 10-year has fallen from 2.94% to 2.56%) the middle of the yield curve has been acting entirely differently....