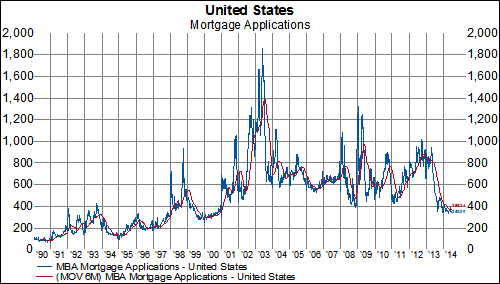

US Mortgage Applications fall to 714-week low

Last week we commented that US mortgage applications weren’t showing the bounce that other housing stats such as housing starts and existing home sales were showing year-to-date. Not only did mortgage applications not bounce back this week, but mortgage applications actually broke down to new lows...