Is the Fed’s Liquidity Pump Responsible for Intraday Price Action?

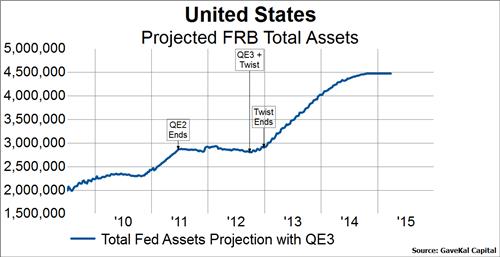

Yesterday we highlighted that our Weak Stock Market Close Indicator indicator had surged to the highest level since 2012 and today a client made the good point that our Weak Stock Market Close indicator seemed to give more false signals when the Fed was engaging in...