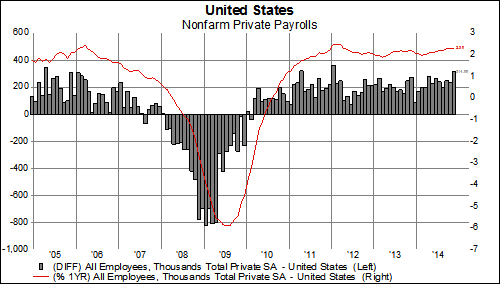

Europe Flash PMI Better, Not Fabulous December 16, 2014

While today’s better than expected rise in the flash PMI indicator (black line) for the euro zone is a welcome surprise, it would seem that it will take quite a bit more improvement before we can reasonably expect substantial progress in the recovery of important metrics such as GDP or industrial production: By country, France

Read More