Still Fighting the Fed

October 03, 2023In the most recent FOMC meeting, the committee decided to refrain from raising rates again, but held open the prospect for further hikes this year. They also took back two anticipated rate cuts next year. Along with the Summary of Economic Projections that the Fed provided in the September meeting, they also provided information as to their disposition toward GDP, employment and inflation.

First, with respect to inflation, we continue to see a trend that has been in place since March. While 14 members of the FOMC now see upside risks to the PCE price index, only 11 did in March, then 12 in June. So, the hawkish narrative that the Fed has been voicing most of the year is backed up by how many more members are afraid of inflation upside.

The exact same dynamics (and numbers) were apparent in the risks to core PCE upside. Since March, the Fed has been signaling in numerous ways an increasingly hawkish stance. This fits with the latest SEP where the Fed raised its projection for PCE in 2023 from 3.2% to 3.3%

Second, looking at unemployment, it is clear members have been getting more worried about the upside to the unemployment rate. In March, 12 members were concerned about the downside to growth. By June, there were 10 members and now there are only eight members worried about GDP downside. This fits with the latest SEP as the FOMC lowered the unemployment rate forecast for 2023 to 3.8% from 4.1% and to 4.1% from 4.5% for 2024.

Lastly, more members are seeing downside risks to GDP growth. In March 2023, 17 members saw downside risks to GDP. By June, it was down to 10 and now there are only eight members. This also fits with the SEP where the FOMC revised up GDP from 1.0% to 2.1% in 2023 and from 1.1% to 1.5% in 2024.

The narrative that comes through in looking at the SEP and the number of members that see upside/downside risks for the economic variables is one of a soft landing, where rates can be held higher for longer.

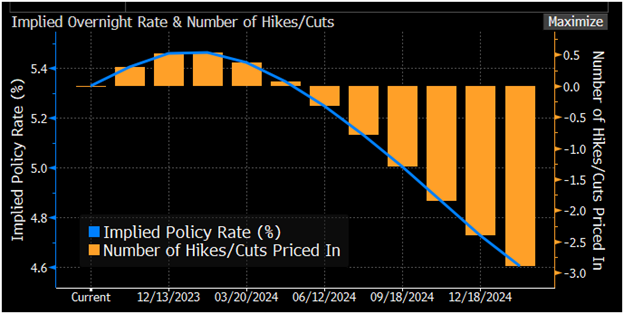

The market doesn’t seem to buy this narrative as it is only pricing a 52% chance of a hike in December. It is also pricing in 2.38 25bps cuts next year. In other words, the market doesn’t see the Fed raising rates again this year and then sees them cutting them more than Powell articulated. Looking at this configuration in a slightly different way (assuming they don’t raise again this year), it could be said the market is pricing in a higher probability of three cuts next year. With these projections it seems that the market is still fighting the Fed somewhat.