Still Fighting the Fed

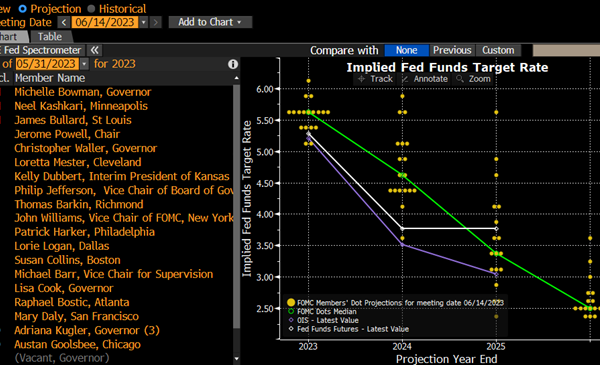

In the most recent FOMC meeting, the committee decided to refrain from raising rates again, but held open the prospect for further hikes this year. They also took back two anticipated rate cuts next year. Along with the Summary of Economic Projections that the Fed...