Hanging Tough? AI Sentiment Shows Hawkish Fed

June 22, 2023After yesterday’s testimony by Fed Chair Jerome Powell to the US House of Representatives I analyzed its sentiment on key issues compared to his previous four FOMC policy statements, using ChatGPT. The table below shows the results.

Unsurprisingly, ChatGPT left the sentiment for both inflation and inflation outlook unchanged, hinting at the Fed’s continued hawkishness.

Next, to test for any shift in sentiment, I looked at recent FOMC member speeches by three Fed governors who addressed Fed policy over the last month, summarized here by ChatGPT.

Summary of Governor Phillip Jefferson’s Speech (one speech):

- Jefferson maintains a cautious approach, focusing on financial stability risks and vulnerabilities, without a significant change in stance.

- Emphasizes the importance of monitoring financial stability risks and the potential impact on monetary policy decisions.

- Acknowledges the ongoing challenges posed by the COVID-19 pandemic and the need for a vigilant and adaptable approach.

Governor Christopher Waller’s Speeches (three speeches):

- Waller acknowledges the interconnections between financial stability and monetary policy, with a cautious approach regarding the recent strains in the banking sector.

- Highlights the separate and distinct nature of the tools used for financial stability and monetary policy.

- Stresses the effectiveness of targeted financial stability tools in addressing strains in the banking system.

Governor Michelle Bowman’s Speech (two speeches):

- Bowman shares concerns about inflation, supporting further rate increases to bring it down, aligning with a hawkish stance.

- Acknowledges the role of pandemic-related supply and demand factors and expansionary fiscal policy in contributing to high inflation.

- Advocates for a sufficiently restrictive stance of monetary policy to meaningfully and durably bring inflation down.

Summary of sentiment:

- Jefferson maintains a cautious approach, emphasizing financial stability and the need for vigilance in a changing economic environment.

- Waller acknowledges interconnections between financial stability and monetary policy but does not indicate a significant change in stance.

- Bowman’s remarks align with a more hawkish view, advocating for additional rate increases to address high inflation.

Here, for example, in today’s speech entitled, “Fed Listens: Transitioning to the Post-Pandemic Economy,” we can see Bowman’s emphasis on persistent inflation (source: FederalReserve.gov).

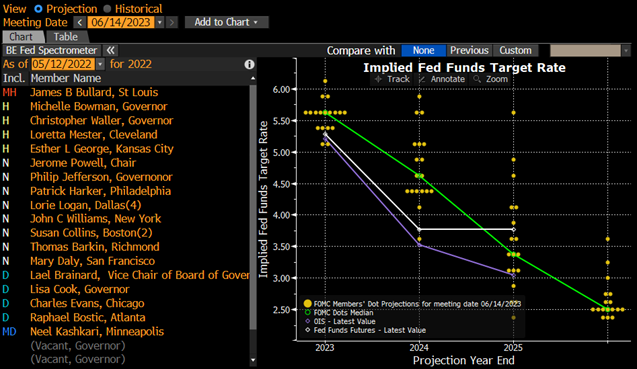

Today, Bowman ranks among the “Most Hawkish” FOMC members in an increasingly hawkish and polarized Fed, according to Bloomberg’s Fed Spectometer (below).

Compared to last year’s Spectrometer, we see more members marked “N” for neutral in 2022 than in 2023. Will sentiment remain hawkish? We’ll continue to monitor FOMC responses to new economic releases over the next month.