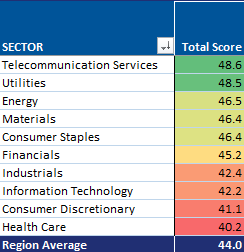

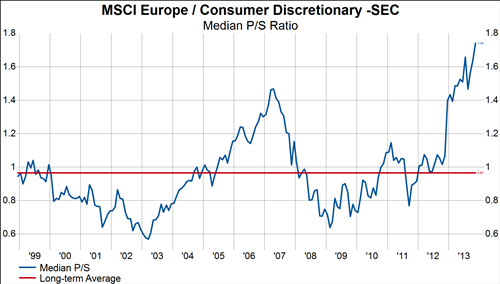

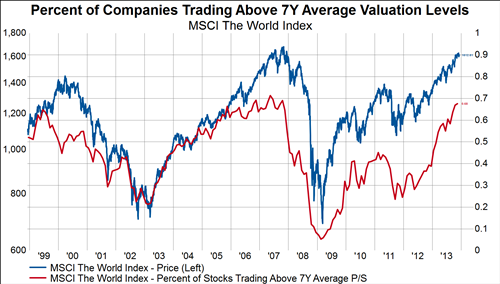

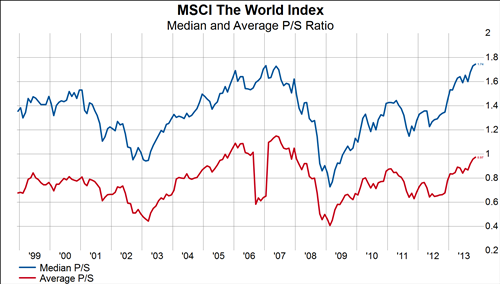

Median Stock Valuations Remain Near Record Highs

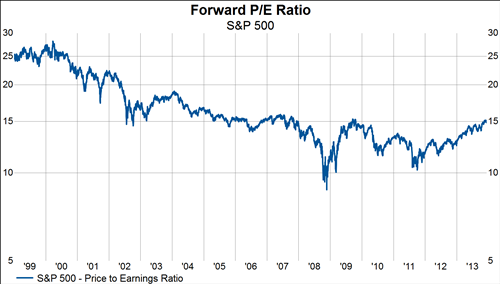

Measuring the valuation level of the median stock in an index can help mitigate the market-cap-weighted bias associated with many index level valuation statistics. This is important because index level valuations that are heavily influenced by a handful of large companies can give a misleading...