You’re Not Imagining It.

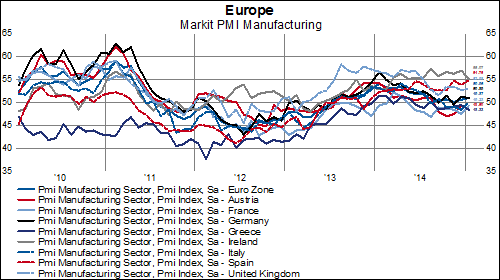

The recent (more than 10% QoQ) slide in the euro is a two-standard deviation event, the likes of which we have not seen since 2010. And, as we can see in the chart above, the only time the euro has declined more versus the USD...