Longer Term Trends Have Reasserted Itself In May

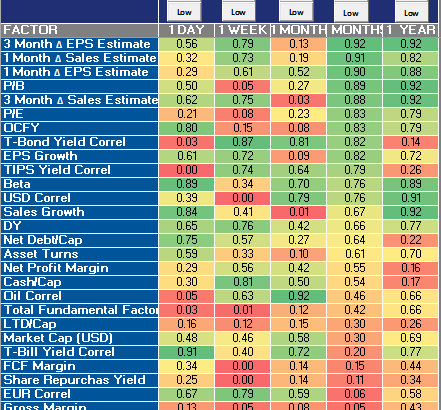

Remember back in April when we noted how equity trends had completely flip-flopped during the first several weeks of the second quarter and we wondered aloud whether this was a trend change or simply a counter-trend rally? Well, so far in May the market is...