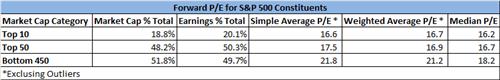

Decomposing the S&P 500 PE Ratio by Market Cap: Most Stocks Look Expensive

Back in December we wrote a piece entitled, ”Decomposing the S&P 500 PE Ratio: How Can the Market PE be ”Low” and Stocks be Expensive at the Same Time?” in which we showed how the market capitalization of the S&P 500, and many other indexes...