Trade War is Boosting US Economic Activity … in the Short-Term

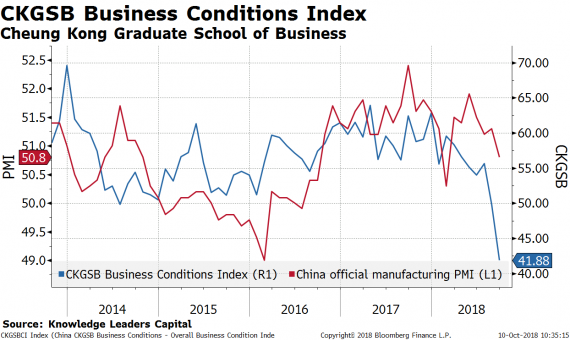

October 10, 2018Overnight, new data released in China suggests businesses are having a tough time lately. Cheung Kong University produces an alternate PMI Business Conditions Index in association with the China Federation of Logistics and Purchasing. The latest data point plunged more than 10 points from its end of July reading and is currently sitting at 41.88, deep into contraction territory.

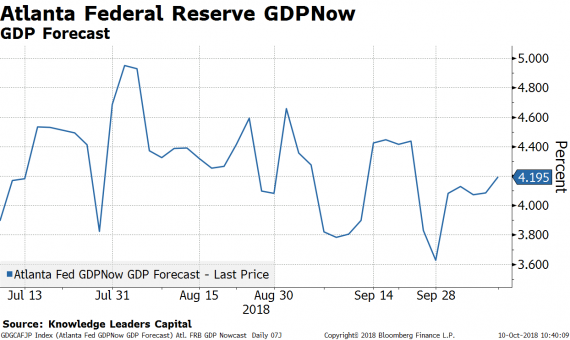

For the US, the story is a bit different. The Atlanta Federal Reserve maintains a now-casting series extrapolating incoming economic data to quarterly GDP now-casts, calculated weekly. In the last week, the Atlanta Fed GDPNow increased by about 11bps to 4.19%. This would make for the second quarter in a row of 4% growth if it materializes.

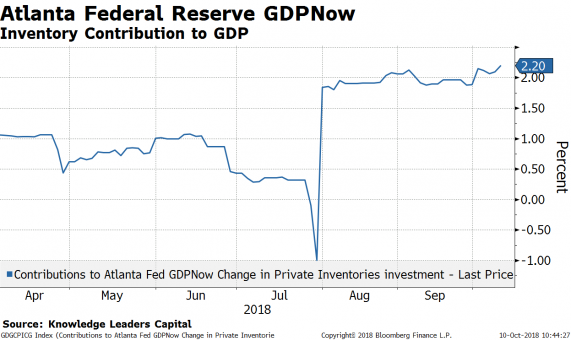

So, what is behind this economic strength that appears to be getting stronger in the back half of 2019? I think the simple answer is tariffs. One telltale sign is that inventory accumulation is driving the increase in GDP estimates. The entire 11bps increase in the 3Q2018 GDPNow can be attributed to the expected contribution from inventories.

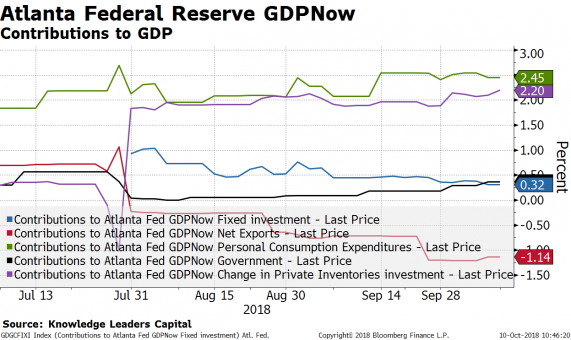

If we break out all the components to GDP, we can see more broadly the shorter-term impact of the trade war. Inventory accumulation is expected to account for over half of GDP growth in the third quarter. Since much of the inventories that are being accumulated are imports, trade is expected to subtract about 1.14% from growth.

In the short-term, US GDP growth is being boosted by businesses rushing to fill the shelves with merchandise before tariffs increase at the end of the year. This activity will likely go on in the fourth quarter too. If this pace of inventory accumulation continues, and by the end of the year companies are sitting on inventories worth 1% of GDP (two quarters of 2% annualized inventory contribution), the risk of a growth air-pocket increases early next year.

Recessions in 1949, 1953, 1960, 1975, 1980 and 1982 were all driven by inventory purges that were preceded by huge inventory builds. There have only been five quarters (out of 70 quarters) since 2000 where inventories contributed over 2% to GDP growth. To be sure, the sort of inventory building we are seeing now is driving US economic activity in the short-term, but as history suggests binges are followed by purges.