Spotlight Ferrari: Under the Hood at the World’s Most Innovative Car Company

May 14, 2019For all the buzz, it would be easy to guess Tesla is the most innovative car maker in the world. But as our intangible-adjusted data reveals, Tesla invests less than half as much on R&D as the most innovative car company in the world.

Invention in the world’s auto industry stands on the shoulders of one company alone, Ferrari. The Italian car maker spends a whopping 18.8% on R&D as a percent of sales, making it, by a wide margin, the most innovative car company in the world. For comparison, BMW spends 7.1% and Tesla spends 6.8%. Indeed, Ferrari’s innovation level is a closer match to that of the average pharmaceutical company.

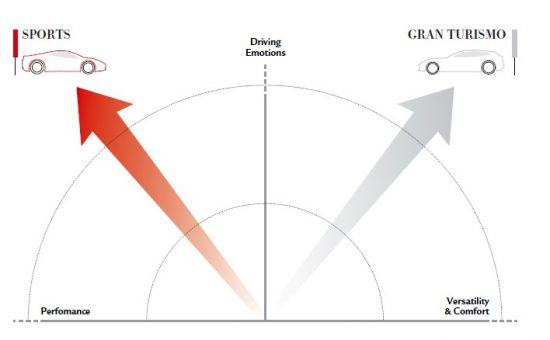

In a report on his case study of the company, Harvard Business School Professor Stefan Thomke defines Ferrari’s strategy as a “careful balancing of three elements: driving pleasure, performance, and style. As the company’s marketing head told Thomke, ‘We are not the fastest or most comfortable car on the market, but the best combination of the two.’ While other sports car manufacturers try to make their cars as light as possible to aid acceleration, for example, Ferrari is not afraid to sacrifice speed for a more luxurious cockpit. ‘They are willing to put on a few extra pounds because the leather feels different,’ says Thomke … Then there is that trademark Ferrari purr. The company has gone far beyond other car makers in creating an engine that not only performs well but sounds great to the driver. ‘They go crazy trying to make a turbo engine sound good,’ Thomke says.”

Ferrari design principles, credit: Ferrari 2018 Annual Report

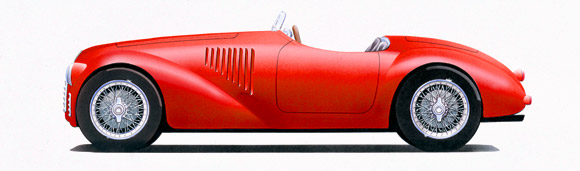

Founded by Enzo Ferrari, who started out racing Alfa Romeo cars until he decided it was time to build his own, the company introduced its first race car in 1947, the 125 S, with a powerful 12-cylinder engine that would go on to become synonymous with the Ferrari brand. The following year, the company introduced its first car for the road, the Ferrari 166 Inter, thus establishing its tradition of innovating for the racetrack and then adapting those technologies for the road. The firm’s eponymous racing team — Scuderia Ferrari — is the longest running Formula 1 team today, having won 235 Grand Prix races including the 24 Hours of La Man and the 24 Hours of Daytona. Scuderia Ferrari is not only the core of the firm’s marketing strategy; it is the key to its innovation strategy too.

Ferrari’s first race car, the 1947 Ferrari 135 S, credit: Ferrari SpA

Every year, new Formula 1 racing requirements and regulations lead Ferrari to design a whole new race car, and the beneficiaries are Ferrari’s enthusiasts and collectors, the company explains in its 2018 annual report. “Formula 1 racing allows us to promote and market our brand and technology to a global audience without resorting to traditional advertising activities, therefore preserving the aura of exclusivity around our brand.”

Ferrari’s top R&D priority at the moment is hybrid engine technology, specifically: designing more powerful combustion engines for lower emissions and consumption without turbo lag. Ferrari raced its first hybrid in 2014 to disappointing results but came back in 2015 after re-engineering to win three grand prix races. In 2013 Ferrari introduced its first hybrid supercar for the road, the Ferrari LaFerrari, with two engines, one 12-cylinder and one electric. The LaFerrari emits less CO2, uses less fuel and promises to hit 60 mph in less than 3 seconds. The battery is recharged by braking or whenever the engine produces excess torque. Because Ferrari plans to introduce hybrid systems into more models in the future, its second R&D priority is the architectural innovation inside its cars made necessary by the new hybrid engines.

The Ferrari LaFerrari, an F1-derived hybrid, credit: Ferrari SpA

A major reason for Ferrari’s commitment to hybrid technology, The Wall Street Journal reports, may be “meeting tightening emissions rules. Ferrari is currently exempt because it makes less than 10,000 cars a year, but will soon break through that limit; this year shipments will exceed 9,000. Its strategy is to introduce expensive hybrid engines.”

Ferrari has no plan to develop self-driving cars. The only autonomous system and artificial intelligence integration customers will see from Ferrari R&D are tools meant to assist a human driver, like predictive breaking and automatic cruise control.

In addition to cars for the Formula 1 track, Ferrari builds four different types of cars for the road: sports models (which account for 60% of sales), gran tourismo models, special editions and the new “Icona” line. Italian for icon, these limited-edition designs are inspired by past Ferraris. Built for Ferrari’s wealthiest, repeat customers, the Icona series also is expected to raise the company’s average profit margins.

A 1948 Ferrari 166 Inter, Ferrari’s first road car, credit: Ferrari SpA

Delivering only about 9,000 cars a year, Ferrari’s low volume production strategy is designed to maintain exclusivity and scarcity. “We carefully manage our production volumes and delivery waiting lists to promote this reputation,” the firm explains in the annual report.

In a classic example of this strategy, last fall, Ferrari invited 250 clients from around the world to travel to its Maranello, Italy, headquarters for a surprise. The crowd showed up, simply trusting, said Ferrari head of Sales Enrico Galliera in a Bloomberg TV interview from the Paris Motor Show, “it was going to be something nice.” The blind reveal turned out to be two new models from the Icona line, the Monza Supercar 1 and the Monza Supercar 2. With total availability of 499 cars split between the two models and costing 1.6M euros each, by launch day in October at the Paris Motor Show, every car was already spoken for. “As always, before it will arrive in the market, we have already identified the lucky few. Every single car has been allocated to a specific name,” Galliera said.

On average, the wait to buy a Ferrari is 12-24 months. There have been rumors of plans to deliver a Ferrari SUV, and Galliera responded to these. “I have to correct you a little bit, we are not going to make any SUV. We are going to deliver something that is called ‘purosangue,’” which translates to thoroughbred in Italian. The concept will be “100% consistent to the DNA of Ferrari. It’s not going to be an SUV. It’s going to be a car delivering a certain level of freedom to use, which is something that we don’t have in our product range… it has been postponed because it is going to be completely breakthrough, and we want to make sure what we deliver will be stunning.”

Due out in 2022 and expected to compete with SUVs from Lamborghini and Bentley, CEO Louis Camillieri also is careful not to call the new vehicle an SUV. “’It’s something you haven’t seen before so don’t give it acronyms,’ Mr. Camillieri said in response to an analyst who pressed him to say if the new vehicle was an SUV or something closer to a sedan,” reported The Wall Street Journal.

Ferrari’s factory in Maranello is the center of its client engagement strategy, drawing visitors worldwide to drive on its private track or order a custom personalized car. There, an in-house team hosts exclusive track driving experiences at Ferrari, on famous tracks around the world and on Europe’s scenic roads. Clients also can hire Ferrari’s “Classiche Workshop” in Maranello to restore and certify any classic Ferrari to its original pristine condition.

The Fiorano Circuit Test Track in Maranello, Italy, credit: Museo Ferrari

Every Ferrari is built and road-tested in Italy, by a team of about 1,500 highly skilled Ferrari engineers. The firm sells its cars through authorized dealers around the world, with the exception of one-offs and track cars, which are sold direct. Ferrari provides training for dealers in sales, after-sales and technical service at an in-house Ferrari Academy in Italy. It also has a team it calls “flying doctors,” Ferrari engineers who travel to service centers around the world to address difficult technical issues for owners. A commitment to employee training is a common value among companies we identify as Knowledge Leaders, and Ferrari is no different: in 2018, the firm boosted employee training hours by over 45%.

As of 3/31/19 Ferrari NV, BMW (Bayerische Motoren Werke AG) and Tesla Inc were not held in the Knowledge Leaders Strategy. Intangible-adjusted data source: Knowledge Leaders Capital and Factset, as of 5/10/19.