German Banks: Cutting Off Nose to Spite Face

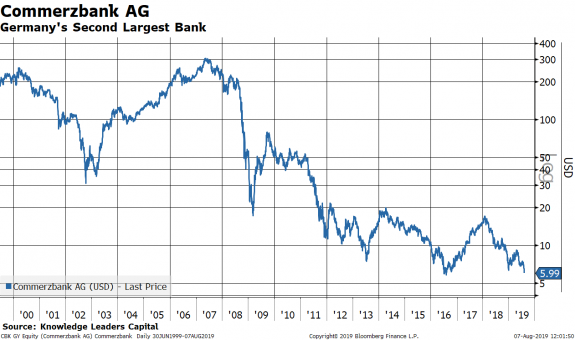

August 07, 2019Today Germany’s second largest bank, Commerzbank, reported a fourth straight quarter of falling revenue and projected lower profit for the year, suggesting clients have been impacted by trade tensions.

Chief Executive Officer Martin Zielke describes the situation: “Despite all the successes we have made, challenges continue to increase for the industry and for us… This might require further investments. And this is exactly what we are examining and assessing in our current strategy process.”

Commerzbank said it still expects a “slight” increase in profit this year, but that goal “has become significantly more ambitious.”

Commerzbank is Germany’s second largest bank with $528 billion in assets. It has $494 billion in total debt leaving a slight $34 billion in equity, or a 6% equity cushion. The stock is down 98% from its $304/share high on 5/9/07, making a new all-time low today.

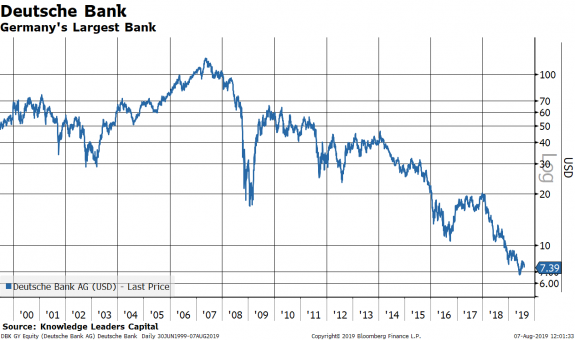

The country’s largest bank is Deutsche Bank, with $1.541 USD trillion in assets and $1.468 USD trillion in debt. That leaves an equity cushion of just $73 USD billion, or about 5% of assets. The stock peaked on May 23, 2007 at $123/share and is down 93% from its high.

So, Germany’s two biggest banks have combined assets of roughly $2.1 USD trillion. Germany’s nominal GDP in 2018 was $4 trillion (USD). Just the two largest of Germany’s banks have assets equal to 50% of nominal GDP. It is estimated that Germany’s Landesbanken—regional banks—have an additional $2 trillion (EUR) in assets. That is well over 100% of GDP if we combine Deutsche, Commerzbank and the Landesbanken.

How does that compare to the US? In 2018, the US had a nominal GDP of $20.6 trillion and total domestically chartered commercial bank assets of $15.2 trillion. So, the entire US banking system, all 4,652 banks (according to St. Louis Federal Reserve) have assets equal to about 65% of GDP.

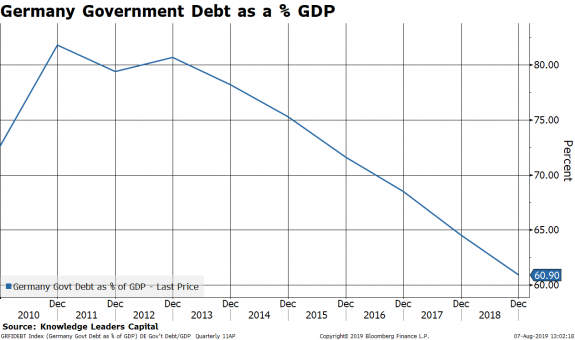

While the rest of Europe has been enthusiastically expanding its national balance sheet, Germany has gone the other way. Germany’s government debt as a percent of GDP has shrunk from 80% to 60% over the last decade.

This behavior has obstructed the European Central Bank’s (ECB) ability to buy bonds to provide monetary stimulus since the ECB had been buying bonds according to the size of the country’s bond market. As Germany shrinks its net debt, it compresses the capacity of the ECB to buy bonds from all members—think Italy.

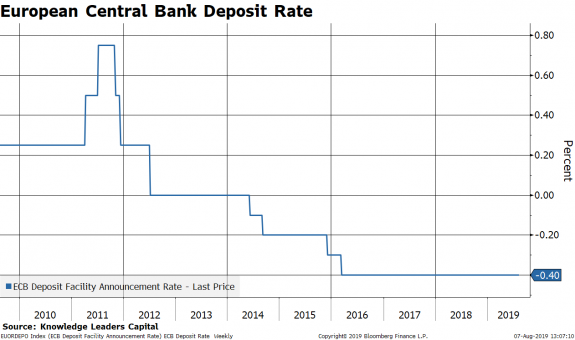

So, in exchange, the ECB has had to resort to negative deposit rates to counter this. Expectations are that the next move of the ECB is to cut the deposit rate to -.5%. That should help German banks…

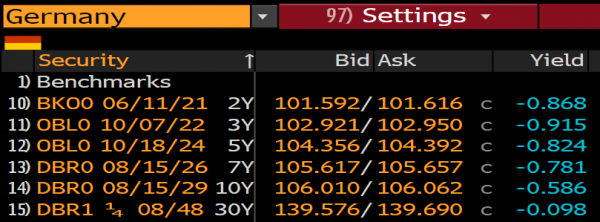

This contradictory fiscal and monetary policy is undermining Germany’s banking system, and possibly the entire European economy. Germany’s yield curve is negative all the way out to 30 years.

Who, in their right mind, wouldn’t borrow as much as a possible if this was the price of money on offer? Germany is cutting off its nose to spite Europe’s face, but bankrupting its banking system in the process.

As of 7/31/19, Commerzbank AG was held and Deutsche Bank was not held in the Knowledge Leaders Strategy.