European Earnings by Sector: Winners and Losers

May 05, 2023While earnings season in the US is winding down, European companies generally take a bit longer to report, which puts us squarely in the middle of Europe’s earnings season. Today, we will examine trends in fully reported developed Europe large-cap companies by sector. Our basket takes the top 70% of stocks by market cap with earnings-per-share surprise capped at +/- 100%.

Overall, average EPS surprise for large cap DM EMEA companies was +6.88%. Revenue surprise also was positive at +2.27%. All averages in this post, including these figures, are quoted on an equal weighted basis.

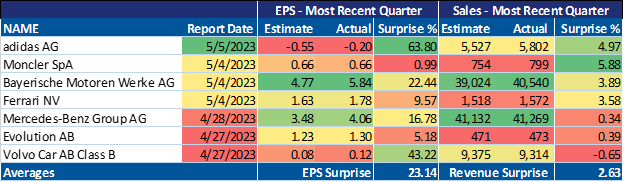

A real star sector in contributing to the positive overall EPS surprise was consumer discretionary. In terms of beating expectations, it came in well above any other sector with an average of 23.14%. Not a single company missed expectations in this sector.

Consumer Discretionary:

The next best performer was health care, with an average EPS surprise of 18.38%. No companies from this sector missed EPS expectations either. One company, arGEN-X SE, a Dutch biotech company, was by far the largest contributor on the upside.

Health Care

Financials closely followed health care in average earnings surprise at 18.26%. Only two firms missed expectations. The first was BNP Paribas with a small downside surprise, and the second was UBS, whose earnings miss was more severe, possibly related to the recent acquisition of Credit Suisse.

Financials

There were just two sectors that comprehensively missed earnings estimates.

European materials firms had a difficult quarter, with an average EPS surprise of -4.1%. In this sector, earnings surprises were mixed on a per company basis, but some especially poor performing firms brought the average down overall.

Materials

The sector with the poorest performance relative to estimates was utilities. Out of the three firms with fully reported data in our basket of European securities, the best performer met EPS expectations exactly with a surprise of 0, while the other two firms missed significantly. Overall, the average EPS surprise was -13.20 percent.

Utilities

As of 3/31/23, Novo Nordisk, Moncler, and Air Liquide were held in the Knowledge Leaders Strategy.