Are European Assets Reflective of Financial Conditions?

June 09, 2023The Euro Stoxx 50 Index is up about 13% year-to-date. Not a bad return for a region whose largest economy is in recession, and whose second largest is facing one of the worst inflation fights in decades. Perhaps the attention-grabbing nature of large economic releases like GDP and CPI paint an overly negative picture when the market is pricing assets in a reasonable manner. One can certainly catch glimpses of growth prospects in Europe. Just this week, we saw every composite and services PMI figure in Western Europe print over 50, save for the Swedish composite. Looking at these figures–along with the fact that the five next-largest European economies after Germany have all avoided recession thus far–gives one some context for the 13% appreciation in the Stoxx Index’s value.

Then again, perhaps it is the market that has become overly optimistic on Europe, thanks to the early success of the consumer discretionary sector this year. Perhaps the negative news we have seen about European growth prospects is correct, and certain barriers to expansion are too present to circumnavigate.

To untangle these two conflicting ideas, I looked at the Bloomberg Eurozone Financial Conditions Index. Notice that the index broke through the 2011 low during October and has hovered around that level since. This immediately demonstrates how poor European financial conditions really are compared to the last decade, including the 2020 pandemic period.

Next I compared financial conditions to the Euro Stoxx 50 Index, looking at just the last five years.

Notice how the Stoxx tracks financial conditions from 2018 up to around mid-July of last year, where there is a complete divergence. This demonstrates that the market had been logically acting as a reflection of the financial conditions in which it exists, but something broke this trend just under a year ago. The separation of asset prices from real conditions tells me investors may have been optimistic about something more niche that exists outside of the economic data.

We see a similar phenomenon when comparing financial conditions to the Euro Spot Rate. In this chart, a divergence forms just a few months after the similar event in the Stoxx comparison.

In this chart, we see the Euro follow financial conditions up to a peak in January 2021 and continue to track them down all the way below parity to 0.96 last September. This low came at the same time the Bloomberg Financial Conditions Index was hitting its low of more than a decade. Since then, financial conditions have changed very little, but the Euro has crept up, back to well over parity at 1.075. This move has taken the currency to a level significantly out of step with where overall conditions say that it should be.

One cause for the out-of-step levels in both charts could stem from the optimism surrounding the China reopening and its predicted positive effect on European luxury stocks. Using our proprietary tables containing a basket of the top 70% of fully reported securities organized by sector, we can filter the data to examine only EMEA large/mid cap companies.

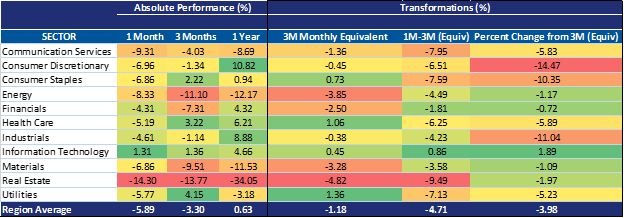

Here, one can see that the consumer discretionary sector was Europe’s top performer over the last 12-months, which is consistent with the timeline of the divergence of asset prices from conditions. It would have seemed to investors that the China reopening optimism was well placed. That said, it became clear throughout the year that China’s reopening came with a little less fanfare than many had predicted. The level of growth in consumer discretionary wasn’t sustained, and we see the sector’s performance rank decreases significantly when we look at more recent data. Over the last three months consumer discretionary had a negative return but still beat the region average. Compare that to the last month alone, where we saw a negative return of almost 7% for the sector, which is lower than the region averages for the period by over a percent. I took a deeper look at this drop-off by taking the 1-month return and comparing it to the average monthly equivalent of the 3-month return for each sector. In this analysis, I found that the actual 1-month return is 651 basis points lower than the average monthly return over the three months. This puts the 1-month return at 14.47% less than the 3-month average, the most significant drop of any sector in Europe.

Of course, this is only one theory as to why asset prices and currency are so separated from conditions, and there is obviously more than one factor at play. Positive figures like the PMIs this week present other arguments for the higher valuations, and there is no law declaring that asset or currency prices must always reflect economic conditions. As we see Europe’s top performing sector for the year turn, there’s a chance these securities could continue their fall and lead the index lower. The gravity of financial conditions has the potential to pull both asset prices and currency back down to its dictated levels at once, which could cause a double-barrel loss for the US investor. With conditions where they are, the question regarding positive European economic news becomes: will it be enough?