Consumer Discretionary Sector Has Driven European Equity Performance YTD

February 10, 2023As inflation fears have receded somewhat—though we’ll see in next week’s US CPI report how much they really have receded—European stocks have had a good start to the year.

In the table below, I take the top 85% by market cap of large-mid firms from European developed markets. I then break out the performance by sector to see the underlying performance trends. Year-to-date the more growth-oriented sectors have led the pack while the more value-oriented have lagged. The consumer discretionary sector in particular has driven performance year to date. This could be attributed to the China re-opening trade as investors expect a torrent of Chinese spending on luxury goods, which European consumer discretionary stocks specialize in. It could also be driven by domestic spending as energy prices have not climbed to heights feared earlier in the Ukraine conflict.

DM EMEA Performance YTD

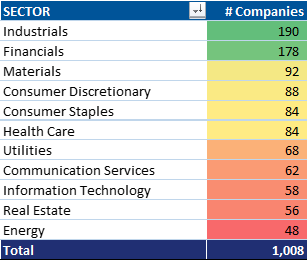

The consumer discretionary sector only represents about 9% of companies in Europe, so a relatively small proportion of the stocks are driving performance.

Top 85% Number of Companies by Sector

To give an idea of how popular European consumer discretionary stocks have been this year, fully 89% of them are outperforming the Morningstar Developed Markets Large-Mid Index year to date. This contrasts to just 4% of European energy stocks that have outperformed year to date.

Percent of European Stocks by Sector that Have Outperformed the Morningstar DM Large-Mid Index

How much room may there be left for European consumer stocks to continue their upward trajectory? It looks like there is still a pretty good runway for subsequent performance of European consumer discretionary stocks. In the table below, I break out by sector the percent of stocks by sector that are down from 1-year highs. Stocks down 0-10% I consider to be in uptrends, while those down 10-20% are in corrections, and those down more than 20% in a bear market.

Percent of Stocks Away from 1-Year Highs by Sector

While 39% of European consumer discretionary stocks are within 10% of 1-year highs, that leaves 18% of stocks in correction territory and 44% in a bear market. If the trends that drove year-to-date performance continue, I would expect more stocks to rise out of bear market and correction territory. With that said, the sector is somewhat overbought. In the next table, I show the percent of stocks above different moving averages.

Percent of Stocks Above Moving Averages

The consumer discretionary sector is the most overbought on a short, medium and longer-term basis. This suggests the sector may need to consolidate to gather the strength for its next move higher.