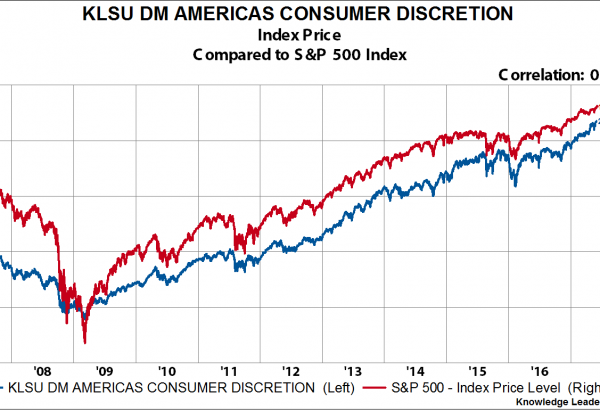

Performance Trends Highlight Our Optimism on Foreign Stocks August 08, 2017

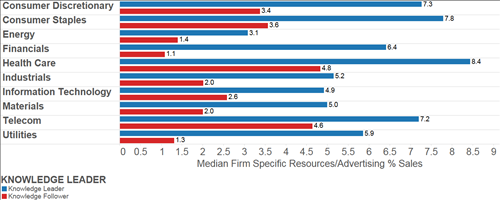

Equity allocators should take note that performance trends in North America are deteriorating while they are picking up outside the US. In the table below, I show the recent performance of the sectors within our KLSU North America index, which captures the top 85% of…

Read More