Are Home Buyers Back in the Game?

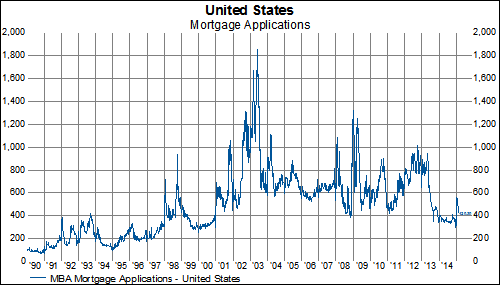

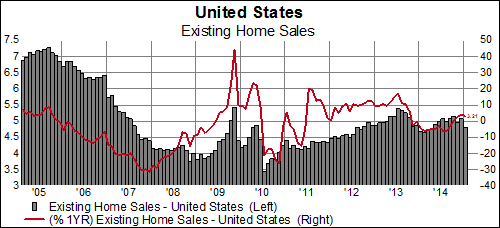

With mortgage rates down, mortgage applications for purchase surged last week, indicating some renewed enthusiasm from potential home buyers. Additionally, the NAHB’s survey of home builders showed what could be a bottom in negative sentiment or at least a reprieve from a terrible 2022. Friday’s...