Is Inflation Starting to Impact Equity Returns?

October 12, 2021Fed funds futures for 2022 and 2023 have broken out to new highs, likely on the back of rising inflation expectations. As things stand now, the market is looking for three hikes by the end of 2023, with the effective fed funds moving from 8bps today to 85bps.

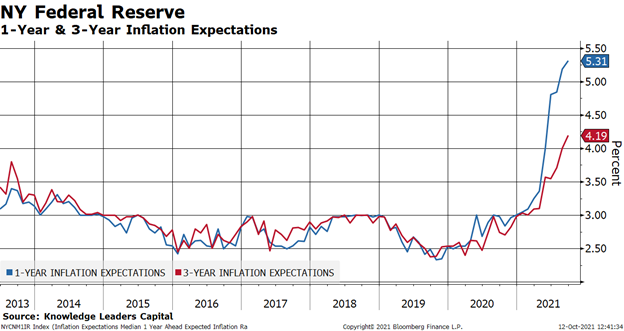

Just today the New York Fed released its monthly inflation expectation survey, and it climbed to new highs.

Tomorrow we get September CPI readings and expectations are that it remains around the current level of 5.3%. The US CPI is pretty well correlated with China’s PPI which appears to be continuing higher. Given this relationship it is hard to see US inflation dropping until it does in China.

And here the news is somewhat disconcerting. With thermal coal prices making new highs, odds are this continues to create upward pressure on China’s PPI and in turn, the US CPI.

Given the movement in the stock market since September 2, the day stocks peaked and December 2023 fed funds futures inflected upward, it is clear the specter of rising rates in response to the less-than transient inflation is starting to bite into the equity market.

Technology has demonstrated it is particularly more sensitive to rate expectations.