The Chinese Yuan is Now in Play… And This Could Mitigate Any Global Slowdown

April 20, 2022The clear and present danger to the global economy is inflation because global central banks are starting to take aggressive actions to deal with what they now believe to be non-transitory inflation. The Fed funds futures curve is signaling a tightening campaign not seen since 1994—and potentially even more aggressive given the balance sheet run-off. There are six more Federal Reserve meetings this year, so in order for the fed funds upper target to rise from the current 50bps to 2.5%, there are going to have to be at least two 50bps hikes in the balance of the year.

The Fed’s policy path stands in contrast to countries like Japan or China, who with economies in need of monetary support, are not following the Fed’s path higher. The release valve is the currency. Japan has been on the frontlines of this battle lately defending its 25bps cap on 10-Year Japanese Government Bonds.

But now, it appears the Chinese Yuan is in play as the next currency to weaken as a result of policy divergences. And a weakening Chinese Yuan is more important to the global economy than the Yen. In the chart below we can see how the Chinese Yuan has been in a structurally rising trend since the onset of the COVID pandemic. Now, with the war in Ukraine in progress, it appears that the direction of travel for the Yuan may be lower. It looks like money is trying to leave China as measured by the spread between onshore (CNY) and offshore (CNH) which opened up in the days following Ukraine’s invasion. Perhaps investors are realizing that money invested in countries of “rule by law” are bad investments.

This may also be a reflection of the JPY/CNY cross-rate that is plumbing to new lows as US interest rates rise. The JPY/CNY rate is fairly well correlated with the rate of 10-Year US Treasury bonds, which may suggest that if the Chinese Yuan is now the focus of capital outflows, this could mark a reversal in rising US interest rates while the JPY/CNH cross-rate rises.

Why could a weakening Chinese Yuan be the variable of adjustment that staves off a Fed-induced overtightening recession? Because a weakening Chinese Yuan is very correlated to US price trends. In the below chart I overlay the CNY with the 1-Year % change in the US CPI. The stronger the Yuan has been since March 2000, the higher US inflation moved.

To be sure, moves in the CNY are very correlated to the ISM manufacturing prices paid. With the CNY appearing to roll over, it is possible we see the upward pressure on manufacturing prices start to ebb, leading to a broader re-evaluation of inflation.

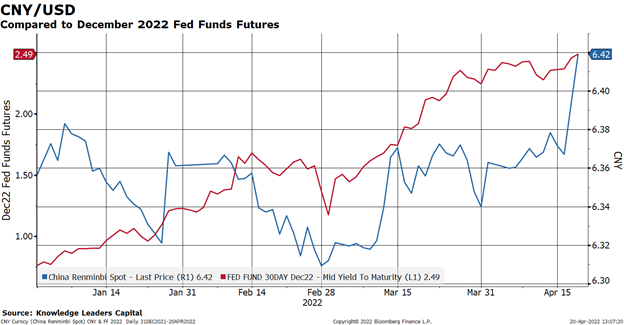

The Chinese Yuan made a low on February 28, four days after Russia invaded Ukraine. Coincidence? At the same time—since everyone knows war is inflationary—Fed funds futures for December 2022 took off, rising by about 125bps. So, the Ukraine invasion was seen by some as further stoking inflation fears while for others is was the catalyst to start moving capital out of China (referring to the CNH/CNY spread discussed earlier).

The $64,000 question that everyone is asking is whether our current inflation is due to demand side factors or supply side factors. While it is probably a bit of both, the fact that more commodities are in backwardation over the last 15 years, this suggests, on-balance, supply side problems are the dominant cause of our current inflation, and commodities should come down in time.

Let’s consider the consequences of commodity prices having topped out (oil, copper, lumber) at the same time US real income is negative, leading to weakening economic volumes. This likely brings fed funds expectations down thereby alleviating the interest spread that is driving the USD higher. Should this come to pass it is likely that the USD begins to decline (against most except China). This alone should be a catalyst for foreign equities. Combine this with the biggest valuation discount of foreign equities to the US in a decade, and the ingredients are in place for foreign equities to overtake US stocks as leadership in the global equity markets.

If we are at peak inflation, peak fed hawkishness, peak interest rates and a peak CNY, inflation could begin to recede soon thereby altering the trajectory of central banks around the world. China’s newfound policy of weakening the Yuan could stave off aggressive rate hikes around the world and recession… and possibly set up the conditions for a period of foreign equity outperformance.