CPI Confirms Fed is Close to Stopping

March 14, 2023Headline CPI came in today as expected at 0.4%, however core inflation (ex food and energy) came in slightly higher at 0.5% versus the estimated 0.4% increase. Before the Silicon Valley Bank failure and currently ongoing banking rout unfolded last week, Jerome Powell said he was leaving “ongoing” hikes and even a larger 50 bps hike on the table, and that the FOMC would consider the “totality” of data (CPI, retail sales, etc.) before making a rate decision on March 22. That “totality” was quickly overwhelmed by a banking sector cataclysm and ensuing rescue by the Fed, FDIC and US Treasury on Sunday. Even after a slightly hotter-than-expected CPI report, the Fed is now expected only to raise rates by 25 basis points more and then stop.

Below I show Bloomberg’s World Interest Rate Probabilities (WIRP) tool capturing the market’s expectations for US Fed Funds following Powell’s hawkish testimony in front of Congress last Monday. At the time the market was expecting an additional three and a half 25 basis point hikes, culminating in 5.5 percent in September.

WIRP as of Monday March 6, 2023

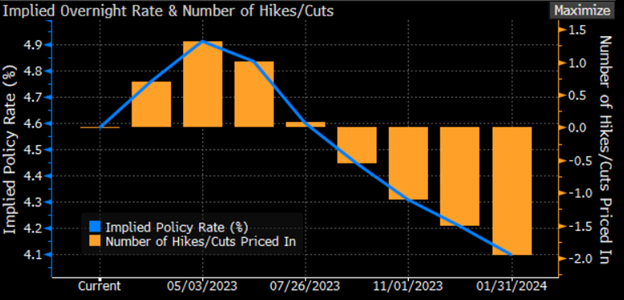

A week later, the market had radically altered its expectations for the Fed Funds rate path, thanks to the failure of three banks, Silvergate, Silicon Valley Bank, and Signature Bank, as well as the realization that other banks were vulnerable to losses in their bond portfolios, due in part to the Fed’s aggressive rate hike trajectory. According to the the WIRP chart below, yesterday before the CPI report the market was only expecting one 25 basis point hike, followed by cuts.

WIRP Monday March 13, 2023

With today’s CPI report coming in with a slightly higher core measure, the market repriced a slightly higher terminal rate of 4.9% versus the 4.6% terminal rate it was pricing in yesterday.

WIRP Monday March 14, 2023

Overall, the CPI report shows inflation is still headed down, and while it might not be headed there as fast as the Fed would like, it did not really increase the odds of a more hawkish terminal rate compared to yesterday.

For instance, looking at the contributors to CPI, we can see here services (ex food and energy) in yellow below has seemingly leveled off, with energy and goods both contributing less to inflation recently.

Importantly, core services ex-housing already has started to decrease. The rent component of housing is expected to decrease in the coming months.

Further, the Cleveland Fed’s CPI Nowcast has inflation continuing to drop in the coming weeks.

While inflation is still high in those “sticky” components of services, there are some bright spots, with goods inflation already down dramatically, and services ex housing starting to roll over. Furthermore, given the banking crisis, which is related to the Fed’s aggressive rate trajectory over the last year, the market is pricing in only one more hike of 25 basis points along with the possibility of a pause or cuts over the next two meetings. Therefore, it is reasonable to expect that the Fed may be close to, or has already arrived at, the end of its rate hike cycle.

As of 12/31/22 none of the securities mentioned were held in the Knowledge Leaders Strategy.