Growth Expectations Are No Longer Cratering For Energy Stocks March 27, 2015

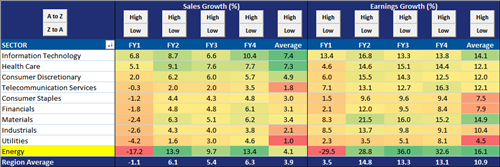

Sales and earning growth expectations for energy stocks are still pretty awful for the next fiscal year (FY1). Sales are expected to drop by 17% and earnings by a whopping -29%. However, earnings are expected to make a V-shaped rebound.

Read More