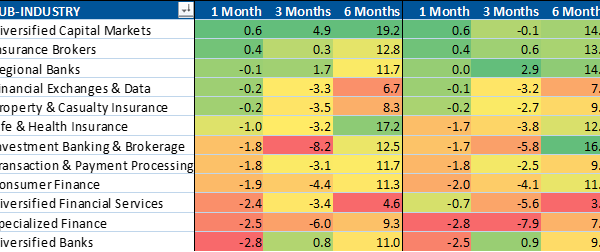

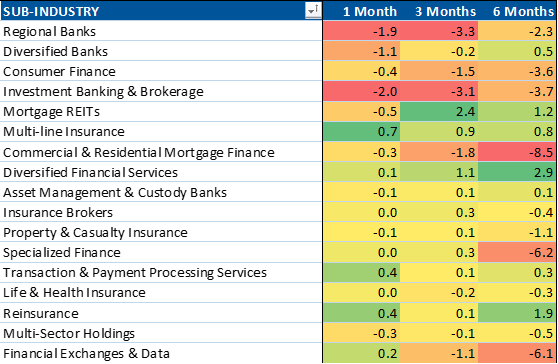

DM Americas Earnings: A Sector View May 04, 2023

With approximately 80% of companies in the S&P 500 reporting, now is a good time to take a look at how developed market Americas (US and Canada) large cap stocks faired on a sector level. To construct our stock universe we take 70% of the…

Read More