Will Higher Rates Threaten the UK Housing Market? June 13, 2014

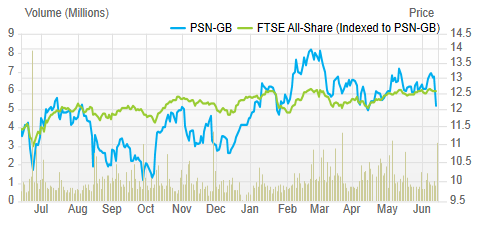

Following Mark Carney’s warning on mortgage debt and rising interest rates in the UK earlier today, homebuilders and home improvement stocks have (not surprisingly) underperformed: PersimmonKingfisher While one day’s movement is not usually a major concern, the 7% and 4% declines, respectively, in Persimmon and Kingfisher will likely result in violations of their support in

Read More