Last Week Copper Stole the Show, This Week it’s Lumber’s Turn March 18, 2014

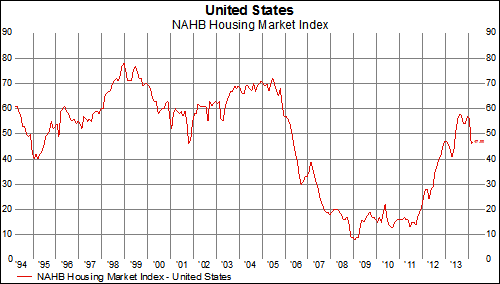

Copper made headlines last week as it plowed through multiple support areas to levels not seen since mid-2010. That move gave market watchers, including ourselves, pause since copper prices are an important leading economic indicator.

Read More