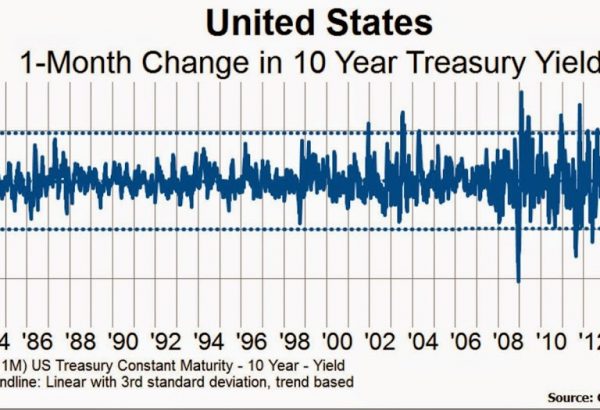

Smart Money Most Committed to Falling Rates Since The Last Peak in Long Bond Yields

Commercial traders (AKA the smart money) has massively flip flopped their positioning since the end of last year with respect to the long bond. In aggregate, commercial traders have moved from a net short position (benefiting when rates rise) of about 50K derivative contracts to...