Developed Market Performance Since the 10/12/22 Low

February 28, 2023Stocks ground into a low on October 12, 2022, and have since recovered about 15.21%. The Morningstar Developed Markets Large-Mid Cap Index has also experienced a golden cross where the 50-day moving average rises through the 200-day moving average. Generally, I view a security trading with the 50-day moving average above the 200-day moving average as being in an uptrend. This is also the 27th day the index has been above the 200-day moving average. Going back to the early 1990s, this duration of 50-day > 200-day performance was at the end of secular bear markets in 2003 and 2009.

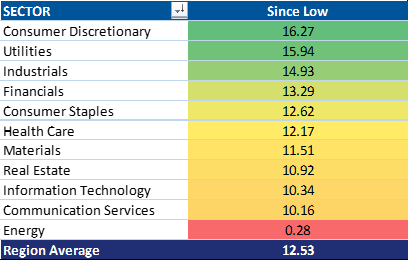

Let’s look at the sector performance of the Morningstar Developed Markets Large-Mid Index since the low. Here we are looking at equal-weighted sectors, looking at the top 85% of market cap, filtered for the 10% least liquid securities. It is a bit of a mixed bag, with the two most prominent value sectors both leading and lagging. Financials have performed the best—not a big surprise with short rates rising—while energy has lagged, reflective of weaker prices.

Developed Markets LM Performance by Sector Since 10/12/22

We separate out our growth and value universes using our intangible-adjusted price/book value. The growth basket has underperformed slightly across sectors, with the consumer discretionary sector performing the best and energy performing the worst.

Developed Markets LM Growth Performance by Sector Since 10/12/22

Looking next at the value universe across sectors, it has outperformed slightly, with the financial sector leading gains and energy the laggard in this basket as well.

Developed Markets LM Value Performance by Sector Since 10/12/22

Performance since the October 12, 2022 low has been pretty broad, with nine out of 11 equal-weight sectors logging double-digit gains. The breadth of the advance, the length of time the Morningstar DM Large-Mid Index has spent above the 200-day moving average, the recent golden cross—these are all reasons to look constructively at the performance of stocks.