Mid-Quarter Update: Tightening Credit

May 17, 2023Credit conditions are tightening in both Europe and the United States. Our analysis follows in our mid-quarter update, Tightening Credit.

Prefer to download this presentation in PDF? Please click here.

1. Summary

-Credit conditions in both Europe and the United States tightened significantly recently.

-We had our AI engine review the European Central Bank Euro Area Bank Lending Survey and the Federal Reserve Senior Loan Officer Opinion Survey.

-In Europe, credit conditions tightened more than expected in the first quarter, though they are down some from the peak in the third quarter of last year. Banks widened margins on loans, increased rejections and experienced reduced demand. This played out in all four major European economies. Respondents reported tightening monetary policy was impacting their lending standards and the demand for credit, and also negatively impacting profitability. This clearly represents a headwind to growth in the Eurozone.

-In the United States, banks reported tightening standards and reduced demand on all types of loans. commercial & industrial, auto and consumer loan standards continued to tightening, representing a headwind to consumer spending. But, the biggest increase in lending standards and biggest drop in demand came in the commercial real estate sector. Overall, the top reasons given for the tightening credit standards were: less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in collateral values and concerns about funding costs.

2. Our AI engine summarized the report for us.

Source: European Central Bank, as of 5/11/23

Introduction

-The April 2023 bank lending survey was conducted among 158 banks in the euro area and contains results for the four largest euro area countries.

-The April 2023 survey asked banks about the situation in financial markets, the ECB’s monetary policy asset portfolio and targeted long-term refinancing operations (TLTRO) III, and bank profitability.

Overview of results

-In the first quarter of 2023, euro area banks’ credit standards for loans to enterprises tightened substantially and were at their highest level since the euro area sovereign debt crisis in 2011. The tightening was stronger than banks had expected.

-Banks tightened credit standards for housing loans in the first quarter of 2023, while the tightening contribution from banks’ cost of funds and balance sheet constraints remained contained.

-In the first quarter of 2023, firms’ net demand for loans fell strongly, with the main drivers being higher interest rates, fixed investment and low consumer confidence. The net decrease in demand for consumer credit became smaller in the first quarter.

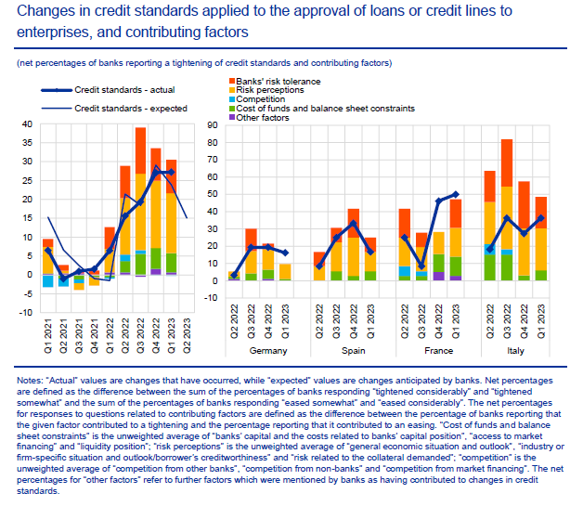

–Euro area banks tightened their credit standards for loans or credit lines to enterprises in the first quarter of 2023, with the pace of tightening being substantially larger than the percentage of banks reporting an easing. Banks’ risk perceptions continued to have the strongest tightening contribution.

3. Credit conditions are tightening to all sectors of the economy.

Euro area banks reported a further substantial net tightening of credit standards in the first quarter of 2023, which was above expectations, but remained markedly below the peak observed in the third quarter of 2022. The tightening was mainly on account of banks’ decreasing liquidity position.

Source: European Central Bank, as of 5/11/23

4. Terms tightened for households and business.

Banks’ terms and conditions for new loans to firms and households tightened further, with the widening of margins on riskier loans having the strongest tightening contribution. At the same time, competition contributed to an easing of banks’ terms and conditions for loans to households.

Source: European Central Bank, as of 5/11/23

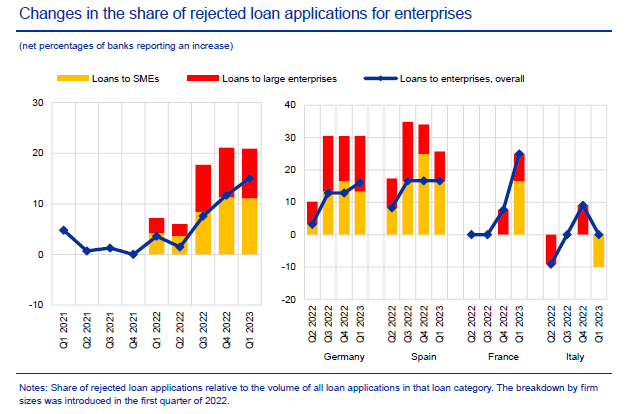

5. Credit rejections continued to increase.

Banks reported a widespread increase in the share of rejected applications for all loan categories in the first quarter of 2023. This is consistent with a further tightening of credit standards.

Source: European Central Bank, as of 5/11/23

6. Credit conditions are tight in the four major European countries.

Credit standards tightened in net terms in all four largest euro area countries in the first quarter of 2023.

Source: European Central Bank, as of 5/11/23

7. Demand for credit is down.

In the first quarter of 2023, firms’ net demand for loans decreased strongly, with the main drivers being high interest rates and reduced fixed investment. The impact of inventories and working capital turned broadly neutral.

Source: European Central Bank, as of 5/11/23

8. Housing loan demand remains weak.

The net decrease in demand for housing loans remained strong in the first quarter of 2023 and was close to the sharp net decrease in demand in the previous quarter. Higher interest rates, weaker housing market prospects and low consumer confidence contributed negatively to lower demand.

Source: European Central Bank, as of 5/11/23

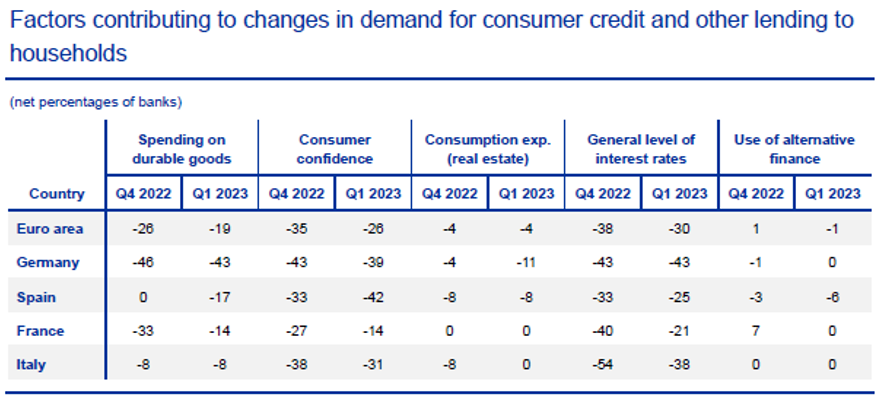

9. Demand for credit is down for multiple reasons.

In the first quarter of 2023, banks reported a net decrease in demand for loans across all four largest euro area countries.

Source: European Central Bank, as of 5/11/23

10. Access to funding has become more difficult.

Euro area banks reported that their access to retail and wholesale funding deteriorated in the first quarter of 2023. This is likely to be due to the increased bank deposit rates and shifts toward more highly remunerated types of saving.

Source: European Central Bank, as of 5/11/23

11. ECB monetary policy has contributed to the tightening of credit.

Banks reported that the ECB’s monetary policy asset portfolio had a negative impact on their market financing conditions, liquidity positions and total assets over the last six months, and also had a net tightening impact on terms and conditions for loans to firms and households.

Source: European Central Bank, as of 5/11/23

12. Phase of TLTRO III is having a negative impact.

Euro area banks have indicated that the ongoing phase-out of TLTRO III is having a negative impact on their liquidity positions, profitability and their overall funding conditions. The impact on lending volumes is expected to turn negative over the next six months.

Source: European Central Bank, as of 5/11/23

13. Tighter credit conditions are weighing on bank profitability.

Euro area banks reported a positive impact of the ECB key interest rate decisions on their net interest margins and net interest income over the past six months, but a negative impact on their volumes and non-interest income.

Source: European Central Bank, as of 5/11/23

14. Banks’ lower risk tolerance is the fastest moving part of tightening credit.

-Euro area banks tightened their credit standards for loans to enterprises in the first quarter of 2023, with a net percentage of 27% reporting a tightening, compared to 27% reporting an easing. The tightening was stronger for long-term loans than for short-term loans.

-The largest tightening impact on credit standards was due to risks related to the economic outlook and industry or firm-specific situation, and banks’ declining risk tolerance. The tightening impact was similar for small-medium enterprises and large enterprises.

Source: European Central Bank, as of 5/11/23

15. We had our AI engine summarize the Senior Loan Officer Opinion Survey.

Executive Summary

-Banks reported tighter standards and weaker demand for commercial and industrial loans and commercial real estate loans.

-Banks reported that lending standards tightened across all categories of residential real estate loans, while demand weakened for all residential real estate loan categories.

-Banks reported tightening lending policies for all categories of commercial real estate loans over the past year, with the most frequently reported changes pertaining to wider spreads of loan rates over banks’ cost of funds and lower loan-to-value ratios.

-Banks expect to tighten lending standards over the remainder of 2023 due to deterioration in credit quality, reduced risk tolerance, and concerns about bank funding costs, liquidity position, and deposit outflows.

-The survey results are tabulated for two domestic bank size categories: large banks and other banks. Mid-sized banks reported tightening standards on business loans more frequently than either the largest banks or other banks, both for the first quarter and in expectation for the rest of 2023.

Source: Federal Reserve, Knowledge Leaders Capital, as of 5/11/23

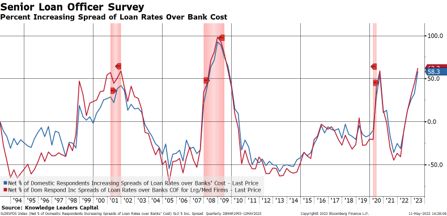

16. Lending standards on commercial & industrial (C&I) loans reached recessionary levels in the April Survey.

–Over the first quarter, significant net shares of banks reported having tightened standards on commercial and industrial loans to firms of all sizes.

-Banks that tightened standards and terms cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, worsening of industry-specific problems, deterioration in their current or expected liquidity position, and less aggressive competition from other banks or nonbank lenders.

Red columns mark periods of recession.

17. Standards were tightened through multiple channels.

These tightenings were most widely reported for premiums charged on riskier loans, spreads of loan rates over the cost of funds, and costs of credit lines.

Source: Bloomberg, Federal Reserve

18. Demand for C&I loans fell to recessionary levels.

Demand for C&I loans over the first quarter was weaker for loans from firms of all sizes, and inquiries regarding new credit lines and increases in existing lines were down.

Source: Bloomberg, Federal Reserve

19. Commercial real estate experienced the most significant tightening and the greatest drop in demand of all loan types.

-Questions on commercial real estate lending were raised in the first quarter. Banks reported tightening standards for all types of CRE loans, and weaker demand for loans secured by nonfarm nonresidential properties.

-Banks reported tightening credit policies on all categories of commercial real estate loans over the past year, including widened spreads on loan rates, lowered loan-to-value ratios, increased debt service coverage ratios, decreased maximum loan size and market areas served, and decreased maximum loan maturity.

Source: Bloomberg, Federal Reserve

20. Various consumer loan types continued to tighten, though to a lesser extent than C&I or commercial real estate loans.

Banks reported tightening lending standards for credit card, auto, and other consumer loans over the first quarter, including increasing minimum credit score requirements and decreasing credit limits, and widening interest rate spreads charged on balances.

Source: Bloomberg, Federal Reserve

21. Auto and consumer loan terms were tightened across the board.

Banks tightened all queried terms on auto loans and other consumer loans on net, including widening interest rate spreads, raising minimum repayments, raising minimum credit scores, decreasing maximum maturity, and raising minimum credit scores.

Source: Bloomberg, Federal Reserve

22. Special Questions on Banks’ Reasons For Changing Standards & Outlook for 2023

-The April Senior Loan Officer Opinion Survey asked banks about their reasons for changing standards or terms for loans across all loan categories over the first quarter. Overall, less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in customer collateral values, and concerns about funding costs were the top reasons given.

-The April survey asked banks about their expectations for changes in lending standards over the remainder of 2023. Banks widely reported expecting to tighten their lending standards over the rest of the year, citing a reduction in risk tolerance, deterioration in collateral values, and deterioration in credit quality of loan portfolio.

-Across bank size categories, major shares of the largest banks expect standards to tighten for the remainder of 2023 due to expected deterioration in credit quality, deterioration in collateral values, and reduction in risk tolerance.

-Large and middle-market firms are defined as those with annual sales of $50 million or more, and small firms are those with annual sales of less than $50 million. For questions about lending standards or terms, the net fraction refers to the fraction of banks that reported tightening or easing, respectively. The survey asked banks about the costs, maximum size, and maximum maturity of credit lines, spreads of loan rates over the bank’s cost of funds, premiums charged on riskier loans, terms on loan covenants, collateralization requirements, and the use of interest rate floors.

-Banks were asked about changes in credit limits, maximum maturity, loan rate spreads, minimum monthly payment, credit score requirements, and extent of loan granting.

Source: Federal Reserve, as of 5/11/23

Prefer to download this presentation in PDF? Please click here.

Disclosures

Knowledge Leaders Capital identifies Knowledge Leaders, or highly innovative companies, by measuring a company’s investment in its future growth. Knowledge Leaders possess deep reservoirs of intangible capital as a result of their history of investing in knowledge-intensive activities like R&D, brand development and employee education. Developed by founder Steven Vannelli and based on decades of academic research, our proprietary model adjusts a company’s financial history to capitalize these investments and reveal the companies with the greatest knowledge intensity. The companies that pass our quantitative screen are identified as Knowledge Leaders.

The information contained herein is provided for informational purposes only and should not be regarded as an offer to sell or a solicitation of an offer to buy the securities or products mentioned, nor should it be regarded as investment, tax or legal advice. Please consult an appropriate professional advisor for advice specific to your situation. Knowledge Leaders Capital may deviate from the opinions, investments, or strategy implementation as discussed in this presentation. The strategies discussed in the presentation may not be suitable for all investors. Knowledge Leaders Capital makes no representations that the contents are appropriate for use in all locations, or that the transactions, securities, products, instruments, or services discussed are available or appropriate for sale or use in all jurisdictions or countries, or by all investors or counterparties.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Knowledge Leaders Capital. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Knowledge Leaders Capital or any other person. While such sources are believed to be reliable, Knowledge Leaders Capital does not assume any responsibility for the accuracy or completeness of such information. Knowledge Leaders Capital does not undertake any obligation to update the information contained herein as of any future date. Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

An investor cannot invest directly in an index. For illustrative purposes only. There can be no assurance that market trends will continue.

This presentation is based on subjective views and opinions of Knowledge Leaders Capital and subject to change.

Past performance or historical trends are not indicative of future results.