Why Has the Chinese Yuan Been So Strong, Will it Last, and What Does it Mean for the US?

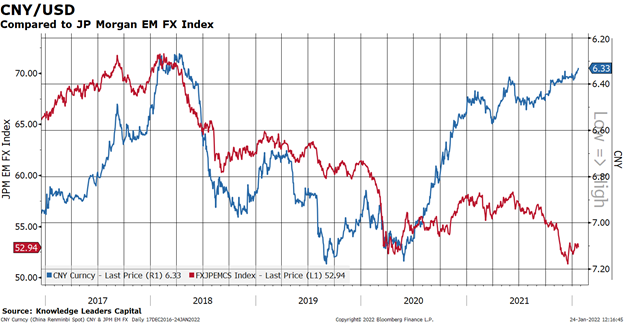

January 24, 2022Since May 2020, the Chinese Yuan has defied the path of other emerging market currencies, strengthening by almost 12%.

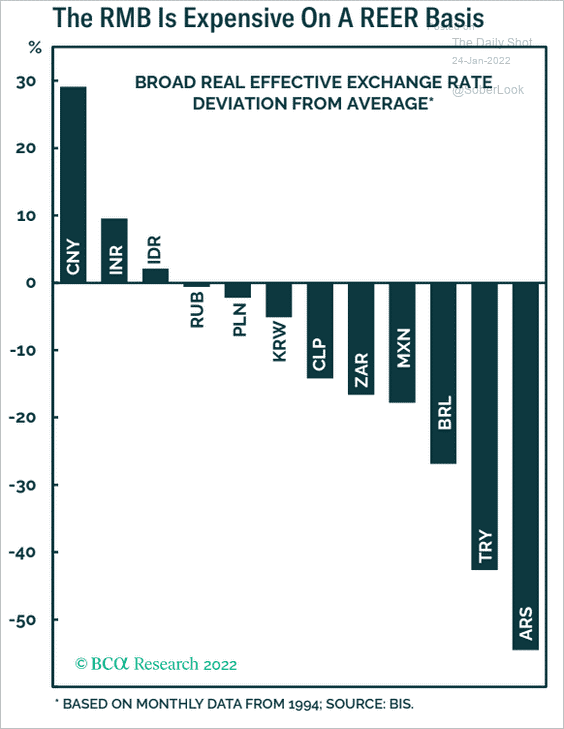

This has left it overvalued compared to other emerging market countries.

While Yuan strength made sense in 2020 when the USD was weakening. It is curious that in 2021, both the USD and CNY strengthened simultaneously.

This is statistically possible because of the relatively small weight (3%) of the Chinese Yuan in the Bloomberg Dollar Spot Index.

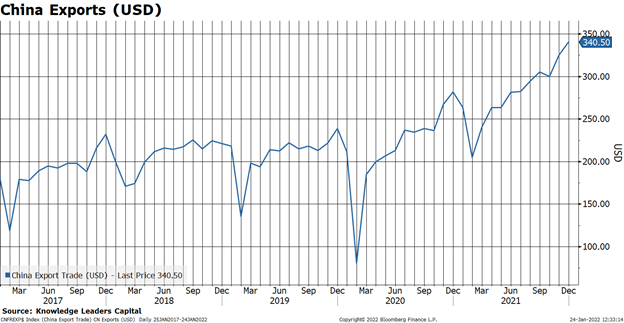

The likely cause for the persistent strength is the surge in exports since the start of the COVID pandemic. From the depths of the initial phase of the pandemic, Chinese exports (in USD) have surged from $100 billion/month to $340 billion/month as consumers around the world shifted purchases from services to goods. In other words, China has been a beneficiary of the pandemic. And this, despite the maintenance of tariffs established in the Trump administration.

In the US, we’re already starting to see pandemic-related demand wane. This helps explain poor earnings guidance from Netflix, Peloton and Lululemon. So, if spending patterns are shifting back as the Omicron variant recedes, we should probably expect the extreme demand for goods imports to recede as well. Could China’s exports be peaking? Could they be peaking at the same time the country is experiencing an internal financial crisis of its own in the property market?

If capital flows into the country start to slow down while possibly the demand for moving capital out of the country picks up, could the next move in the Chinese Yuan be down?

We have a variety of indicators that relate to the movement of the Chinese Yuan, and they are “out of line” in our thinking.

For starters, as the Federal Reserve (Fed) telegraphs the beginning of a rate hiking cycle, the People’s Bank of China (PBOC) is going the opposite direction by loosening policy in a variety of ways. These divergent paths have led to a closing of the 2-year interest rate spread on government bonds. At this level of rates, the CNY should be closer to 7.0-7.10.

Over time the Chinese Yuan tracks US Treasury term premium trends, albeit with some noise. Since March 2021, the US Treasury term premium has retreated steadily as the Chinese Yuan kept rising.

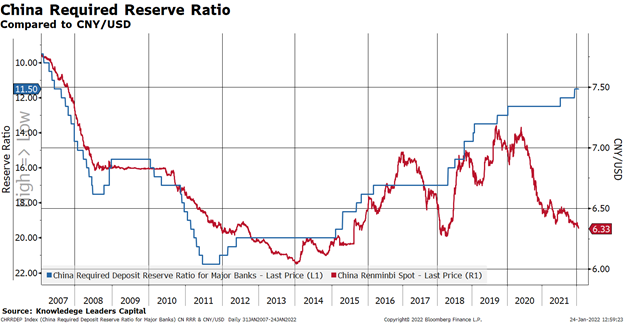

China’s easing moves to help the economy through the property issues are also consistent with a cheaper Chinese Yuan. The PBoC has been steadily reducing the required reserve ratio since 2018. The current reserve requirement is consistent with a CNY below 7.0.

Chinese authorities also have kept a lid on interbank rates with SHIBOR having declined during 2021, suggesting a CNY around 6.9.

But, the Chinese authorities have stopped short of flooding the system with money, leading to 9% year-over-year M2 growth. Interestingly, the Chinese Yuan tends to be weak as money growth slows. So, despite the still decent 9% year-over-year growth in M2, it is a far cry from the days of 15+% money growth. Here again, the rate of money growth suggests a CNY with a 7-handle.

The China & Hong Kong Economic Policy Uncertainty Index is a decent coincident indicator for the CNY. It rose in 2018, dragging down the CNY/USD, after the initiation of tariffs and other trade policy measures put in place by the United States. After the 2020 election, the uncertainty dropped as expectations were for the Biden administration to take a more collegial stance toward China relations. But, in 2021, as it became clear that the tariffs were going to stay, the Uncertainty Index bottomed. Since the beginning of President Xi’s reform push in China, uncertainty has risen, yet the CNY has continued to strengthen. Current levels of the Economic Policy Uncertainty Index suggest a CNY in the 6.70-6.8 range. If uncertainty continues to rise, so do downside targets for the CNY in our opinion.

While the Chinese bond market has been strong, i.e. yields lower, the CSI 300 has struggled, resulting in Chinese bonds outperforming stocks since February 2021. The stock/bond relationship tends to track the CNY pretty well. The relative underperformance of Chinese stocks vs. bonds would suggest the CNY should trade in the 6.6-6.7 range.

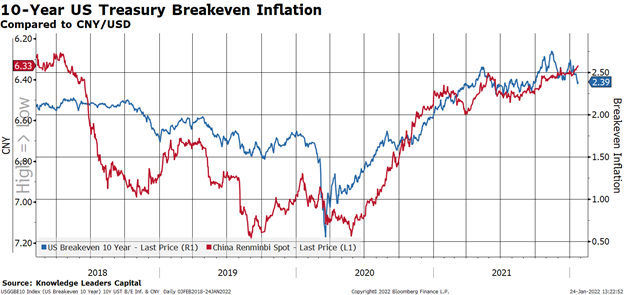

Why does all this matter? Why the obsession with the Chinese currency? Because a strong Chinese Yuan tends to be globally reflationary and a weak Chinese Yuan tends to be globally deflationary. In other words, China has been an unrecognized contributor to the inflationary environment in the US.

With the Markit PMI Composite for the US clearly weakening, having fallen from 68.7 in May 2021 to 50.8 as of this writing, it seems to us just a matter of time before the CNY begins to weaken. And this weakening will contribute to the drop in inflation many expect over the next few years.

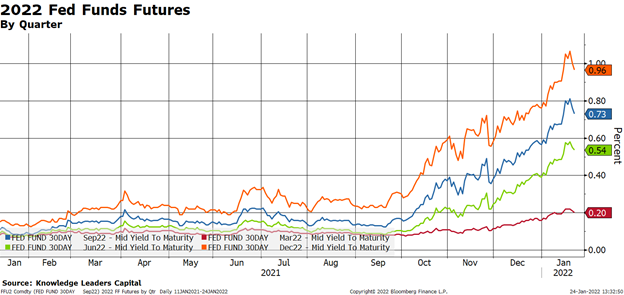

This is, of course, the week the Fed meets. Since the Fed’s hawkish pivot in December, expectations for more rate hikes have been rising. So much so, now expectations for December 2022 rates exceed the Fed’s most recent dot plot.

A weakening CNY could be Jay Powell’s best friend and in turn, risk assets as well. If inflation drops faster than expected, the pressure to raise rates may turn out to be less acute. Perhaps this is why the Eurodollar market suggests only a 20% chance of Fed tightening in 2024, with the rate leveling off around 2%.

If the terminal fed funds rate turns out to be less than the 2.5% communicated by the Fed, stock multiples may have a good bit more to drift upward. If the terminal fed funds rate turns out to be only 2%, stock multiples have lots of upside.

As of 12/31/21, Netflix, Peleton and Lululemon were not held in the Knowledge Leaders Strategy.