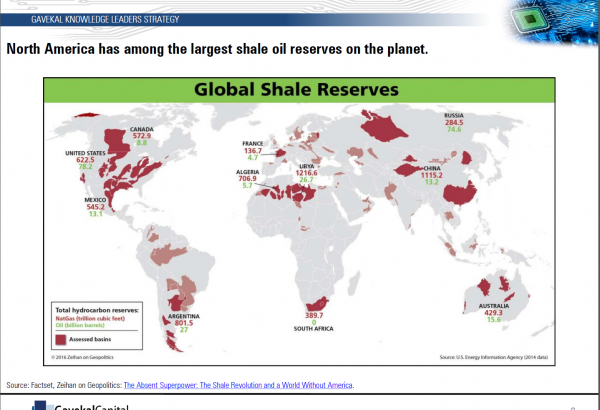

Three Geopolitical Shifts to Watch this Summer, a Q&A with Peter Zeihan: Part 2 – China, North Korea and Trump May 24, 2017

We met with Geopolitical Strategist Peter Zeihan for a quarterly update right before the French presidential elections. In addition to calling Macron’s win, Peter outlined the three most important geopolitical shifts for US financial advisors to watch in the coming months. In order of priority:…

Read More