What are JGBs Trying to Tell Us? March 23, 2023

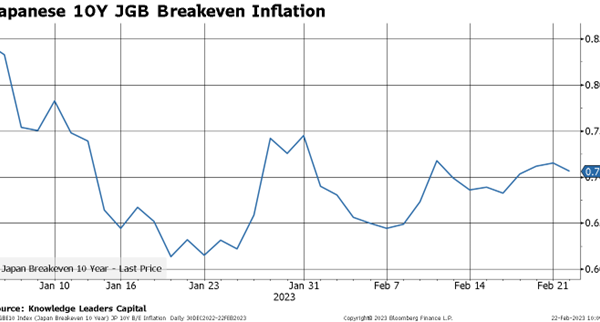

Yields on 10-Year Japanese Government Bonds have fallen by about a third over the past two weeks, as shown in the chart below. Given the tumult surrounding banks recently, and a series of relatively dismal economic data releases out of Japan, this isn’t exactly surprising….

Read More