North America Sector Performance Since the October Low March 02, 2023

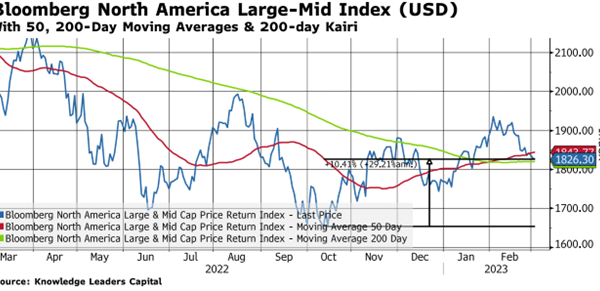

North American developed market large-mid stocks (United States and Canada) bottomed simultaneously with other developed markets on 10/12/22, recovering over 10% since then. Also since October, the Bloomberg North American Large-Mid Index has experienced a “golden cross” wherein the 50-day moving average rises above the…

Read More